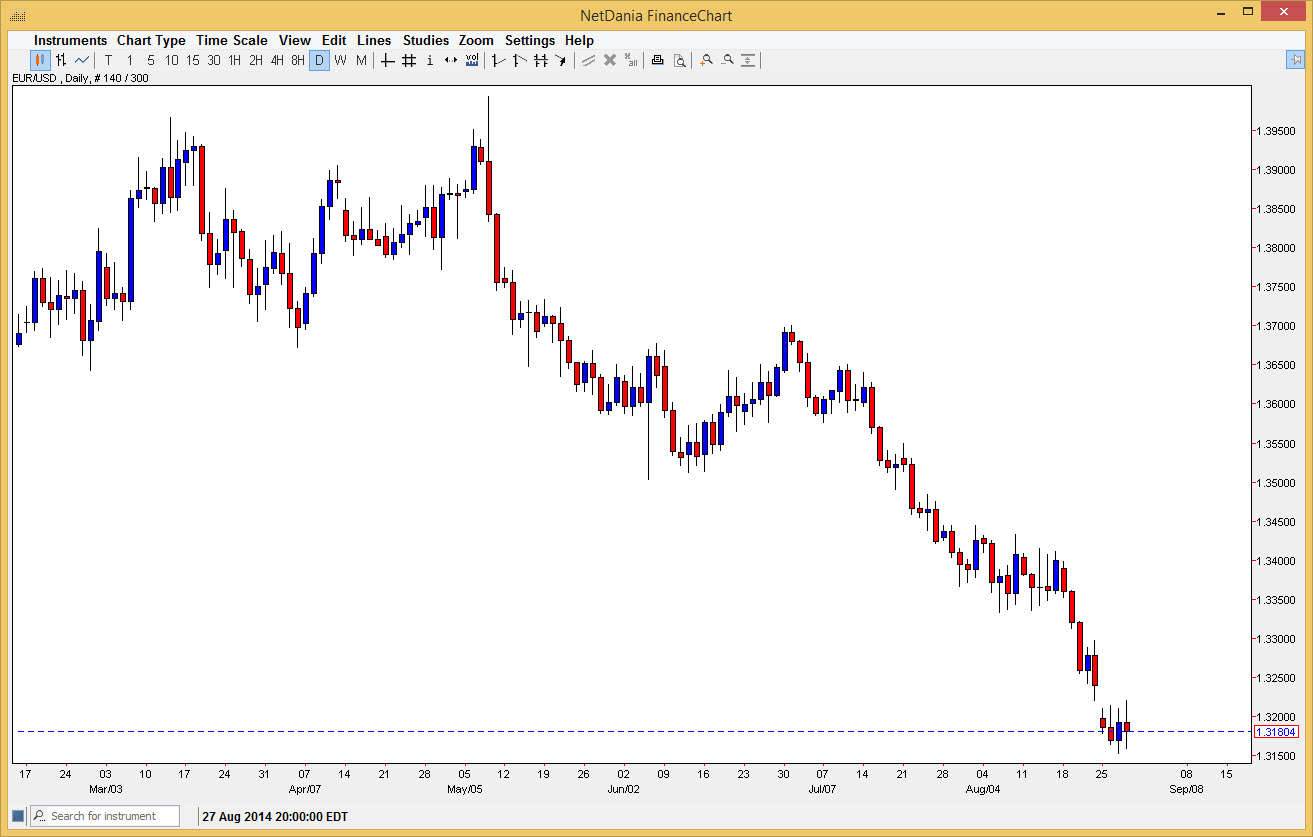

The EUR/USD pair tried to rally during the course of the day on Thursday, but as we have seen over the last several sessions, the sellers step been above the 1.32 handle. With that, the market formed a little bit of a shooting star, but it appears that at the moment the market is simply content hanging about this general vicinity. I think that this market will ultimately reach towards the next significant support area, which of course is the 1.30 handle. I believe that area will of course be rather supportive based upon the fact that it is a large, round, psychologically significant number. We will probably bounce from there, but I do think that ultimately the real support is closer to the 1.28 handle based upon longer-term charts.

I think that the Euro is going to be under a significant amount of pressure for some time as the European Central Bank looks likely to do something to loosen monetary policy. There is a lot of debate as to exactly what they will do, but the reality is that deflation is a very serious possibility and Europe, and that of course will have central bankers jumping to attention.

Beginning of a longer-term cycle?

I’m not sure, but we could be facing the beginning of a longer-term downtrend. It really comes down to the 1.28 handle, and if it gets broken to the downside. Because of it does, there isn’t much in the way of support for quite some time. I don’t think that it’s going to be easier break down below that level, and I also don’t think that is going to happen anytime soon. However, that might be where were heading towards during the end of this year. If that’s the case, this could be a fairly wild and choppy marketplace for the next several months, before finally absolutely collapsing, which is exactly what the 1.28 level giving way would be: a collapse of the Euro. Ultimately, there’s a lot of work to do between now and then, and there will obviously be a lot of headlines that will move the market back and forth, but this is a significant danger at this point in time.