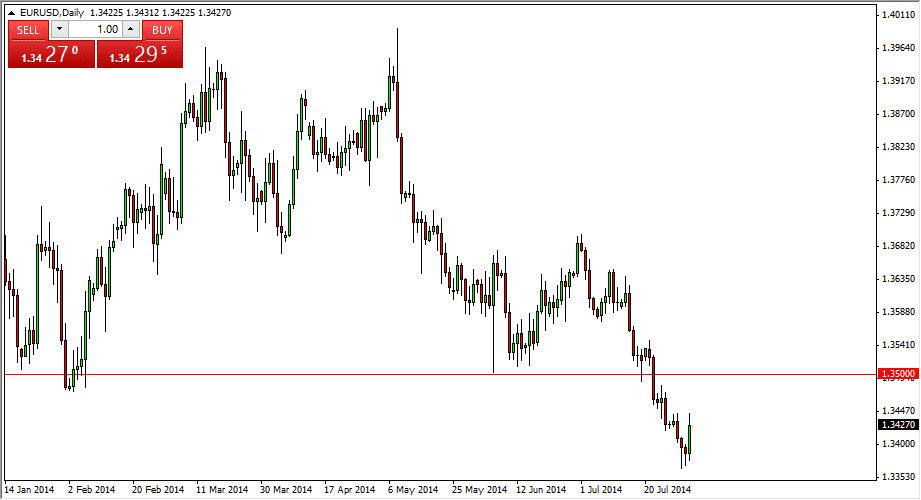

The Euro got a bit of a reprieve on Friday after a somewhat disappointing nonfarm payrolls number out of United States. During the month of July, the United States added about 25,000 less jobs than anticipated, therefore the US dollar sold off a little bit. At the end of the day though, I believe that the Euro was just oversold to begin with and as a result this was a move that you shouldn’t read too much into. In fact, I’m still very bearish, but recognize that we may need to continue going higher, perhaps as high as 1.35 where I see selling quickly entering into the marketplace.

Ultimately, it appears of the European Central bank will have to loosen monetary policy, as we’re starting to see fears of deflation in places like France and Germany. Remember, Germany is roughly 85% of the European Union’s output, so of course it’s all about Germany most of the time. There are also concerns now about a Spanish default yet again, and as a result the-year-old probably be somewhat toxic.

Tight range?

I think that we will probably still continue to see a fairly tight range in this pair, at least for the rest of August. There is very little out there that should be moving the markets in it of itself in the short-term, so I feel that the market will more than likely head down to the significance or barrier that I see of 1.33 handle. We’ve not had that area so I’m not necessarily convinced that the market can’t bounce.

On the other hand, playing devil’s advocate I have to admit that if we got about the 1.3550 level, the Euro would probably continue to strengthen against the greenback, heading towards the 1.37 handle. I see a significant amount of resistance there, so on that move we could simply reenter the previous consolidation or that we had been in for a couple of months, meaning that we are essentially the market that is going nowhere, something that we should be fairly used to by now.