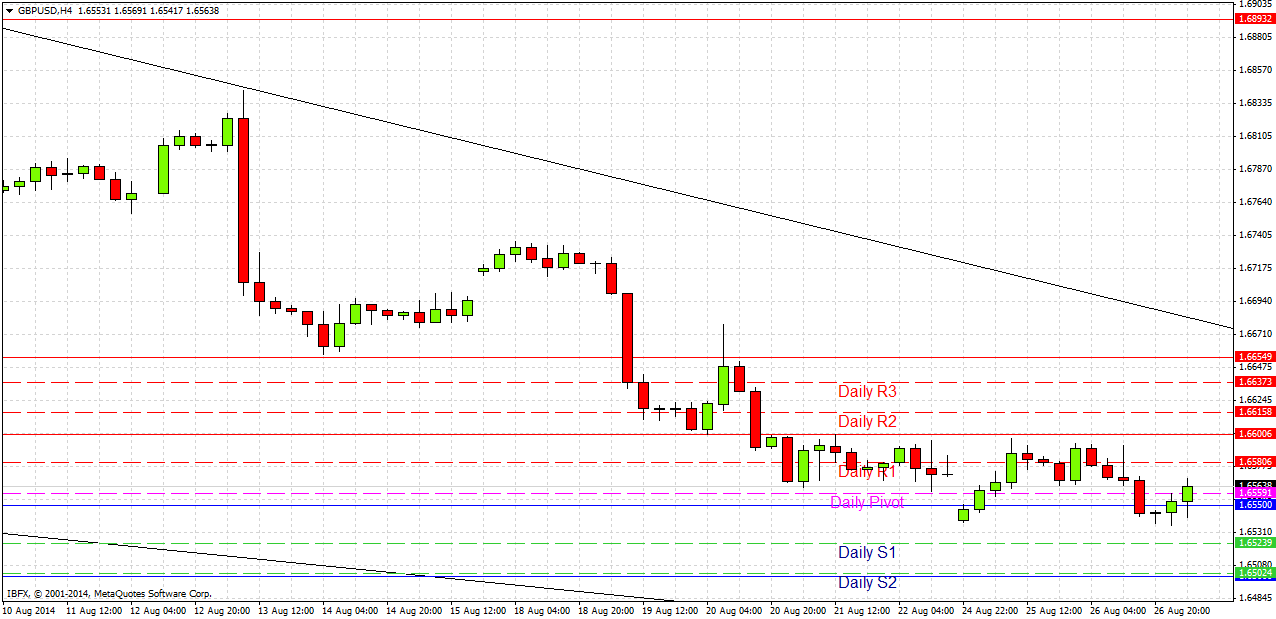

GBP/USD Signals Update

Yesterday’s signals expired without being triggered.

Today’s GBP/USD Signals

Risk 0.75%.

Entries may be made only between 8am and 5pm London time today.

Long Trade

Long entry following bullish price action on the H1 time frame after the first touch of 1.6500.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.6550.

Remove 75% of the position as profit at 1.6550 and leave the remainder of the position to ride.

Short Trade 1

Short entry following bearish price action on the H1 time frame after the first touch of 1.6655.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.6600.

Remove 50% of the position as profit at 1.6600, half of the remainder at 1.6550, and then leave the rest of the position to ride.

Short Trade 2

Short entry following a strong lower high after the price exceeds 1.6598.

Put a stop loss 1 pip above the local swing high.

Remove 75% of the position when profit is twice risk and leave the remainder to ride.

GBP/USD Analysis

The strong downwards trend is still continuing. The USD is the strongest currency right now, while the GBP is quite weak in contrast.

Early this morning, the price bounced off the old support level I identified last week at 1.6550. It would not be surprising if we now have a bullish pull back, although that support might be used up by now.

Once we get back to around 1.6600 or higher, the price is quite likely to fall again.

The key round number of 1.6500, which has also acted as flipped support and resistance, should act as support in the unlikely event that we get down there today.

There are no high-impact data releases due today concerning either the GBP or the USD, so it likely to be a quiet day.