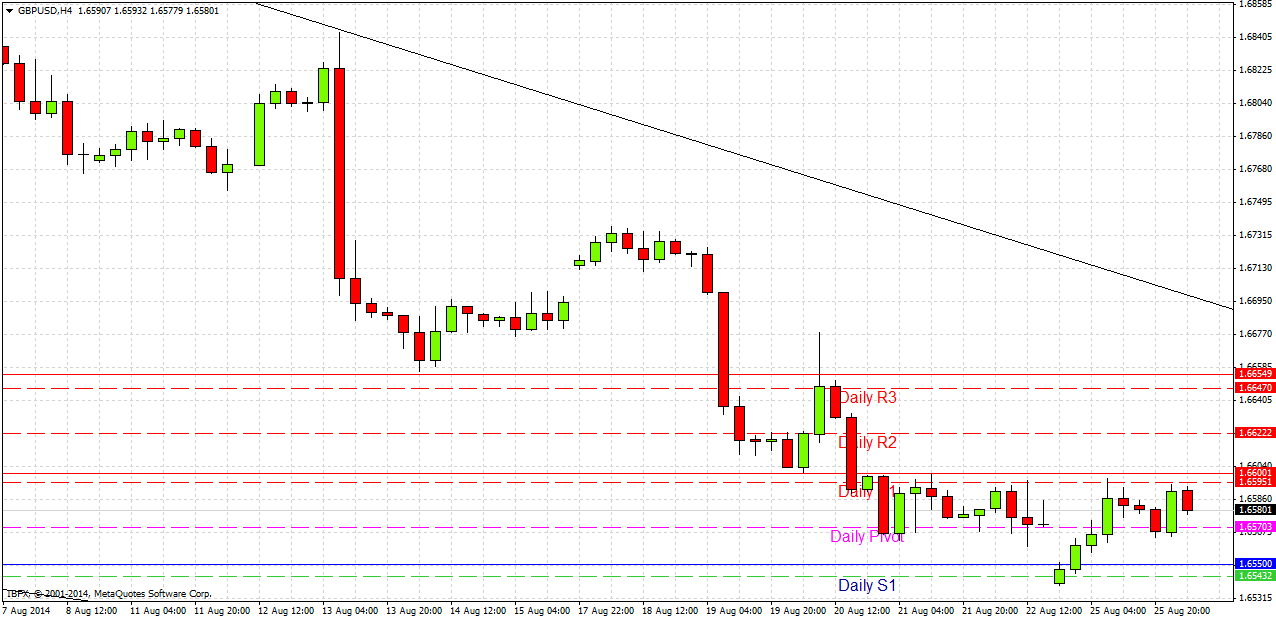

GBP/USD Signals Update

Last Thursday’s signals were not triggered as the price did not reach 1.6550 or 1.6655 that day.

Today’s GBP/USD Signals

Risk 0.75%.

Entries before 5pm London time today only.

Long Trade

Go long following bullish price action on the H1 time frame after the first touch of 1.6500.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.6550.

Take off 75% of the position as profit at 1.6550 and leave the remainder of the position to run.

Short Trade 1

Go short following bearish price action on the H1 time frame after the first touch of 1.6655.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.6600.

Take off 50% of the position as profit at 1.6600, half of the remainder at 1.6550, and then leave the rest of the position to run.

Short Trade 2

Go short following a strong lower high after the price exceeds 1.6598.

Place a stop loss 1 pip above the local swing high.

Take off 75% of the position when profit is twice risk and leave the remainder to run.

GBP/USD Analysis

The strong downwards trend has continued. The USD is very strong and the GBP has recently weakened and that has obviously resulted in this pair falling sharply.

Yesterday was a public holiday in the U.K. so was fairly quiet. It is notable that the support at 1.6550 did hold in spite of the price opening just below that level this week, and not surprising that the banks tried their usual trick of getting the price to gap down below such support over the weekend. The gap has been filled and we have just seen a slight strengthening of the GBP.

It currently looks like the best trade will be waiting for a pullback to around the 1.6600 – 1.6650 area, from which the price is quite likely to fall again.

There are no high-impact data releases due today concerning the EUR. Regarding the USD, at 1:30pm London time there will be a release of Core Durable Goods data, followed by CB Consumer Confidence at 3pm, both of which are likely to affect the USD. This pair is likely to be more active during the New York session.