Gold prices continued to fall during yesterday's session and closed the day at $1298.26 an ounce as a friendly risk environment have provided better investment opportunities elsewhere. Israeli and Palestinian leaders agreed to extend a five-day ceasefire by 24 hours and resume current negotiations. Hopes of diplomatic solution to the Ukraine crisis weighted on the market as well. Russian Foreign Ministry said issues related to the humanitarian convoy to southeastern Ukraine had been resolved.

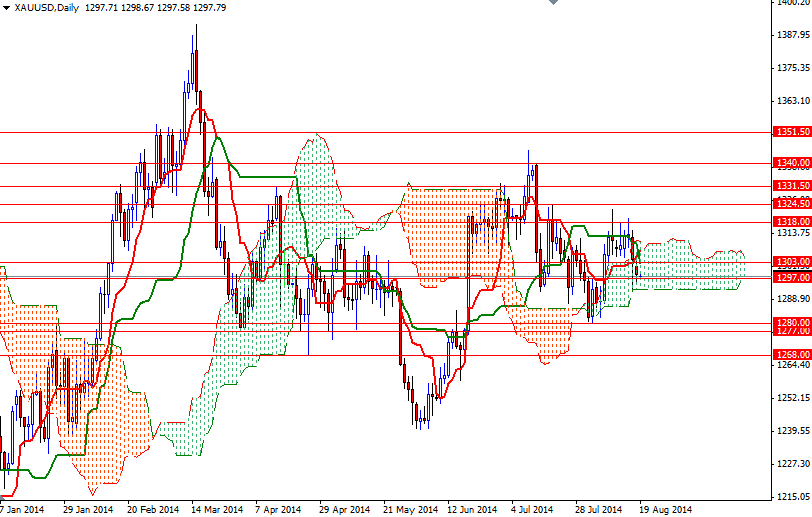

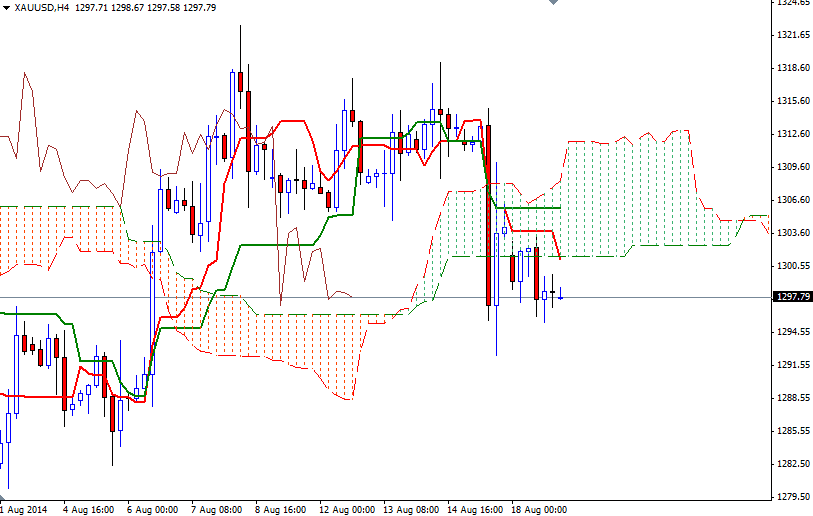

Easing geopolitical risks dulled desire for safe haven diversification for now but we continue to monitor developments cautiously. We have a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross and prices are below the Ichimoku clouds on the 4-hour chart. The XAU/USD pair is testing the support around the 1297 level during the Asian session, by the time I prepare this analysis. If the bears capture this camp, the next support to watch will be around the 1292 level which happens to be the bottom of the Ichimoku cloud on the daily time frame. A daily close below this level means the 1287/6 support could be the next stop.

However, the market is currently trapped in side the daily cloud so the game is not over for the bulls. If they can push prices back above the 1303 level, the XAU/USD pair might revisit the 1310/2 resistance. Only a sustained break above 1318 would make me think that the pair is ready to tackle the critical resistance at 1324.50.