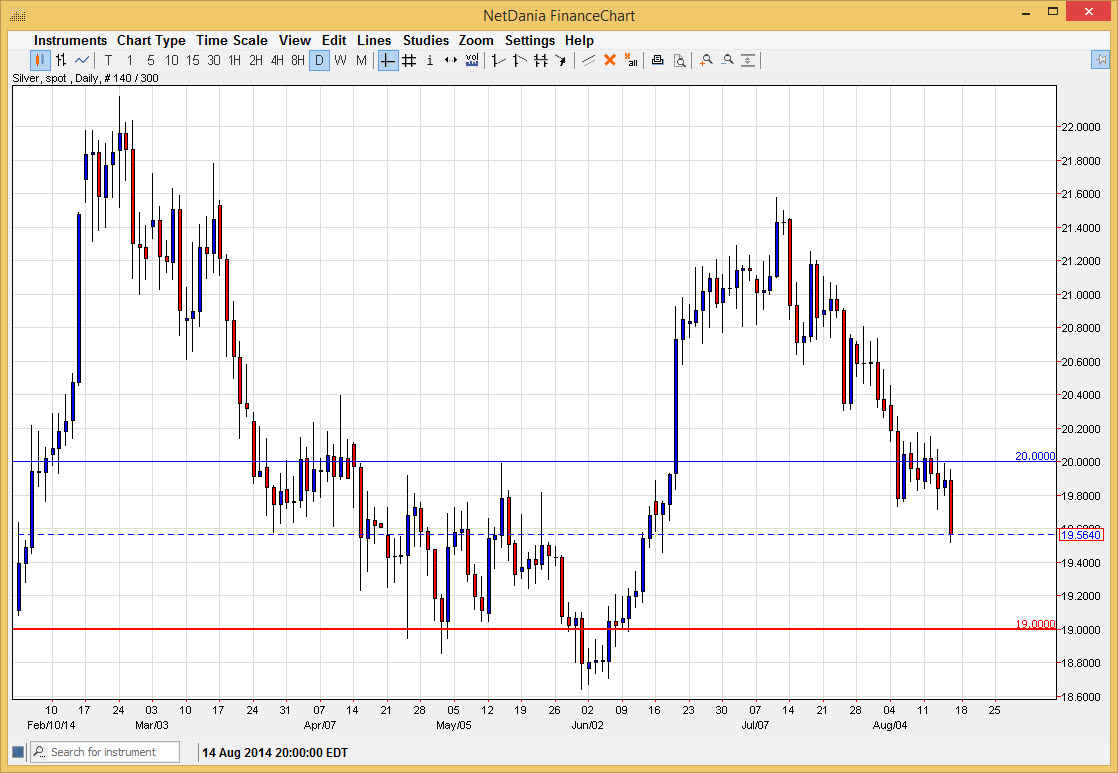

Silver markets fell rather hard during the course of the day on Friday, breaking well below the $19.80 level. The market looks very bearish after the move on Friday, but ultimately we believe that the $19.00 level certainly has quite a bit of support at its, and that means that we should continue to find buyers down there. In fact, when you look at the longer-term charts, the $19.00 level has been supportive for quite some time, and ultimately I believe that the area should offer nice buying opportunities.

In the meantime, I have been buying physical silver from time to time, and a certainly think there’s a lot of reasons the think that below we should get buying opportunities that allows for longer-term “buy-and-hold” type of opportunities. After all, the area has been so supportive, and longer-term I truly believe that the US dollar will continue to weaken. It may not of the next several months, but at the end of the day if you are buying silver in its physical form, it is a longer-term trade by its very nature to begin with.

Think of it as value.

Think of buying silver in its physical form as the” value” at this point in time, as the market has sold off so significantly. At the end of the day though, I think that if we do in fact get a nice bounce on the 19 100 dollars level, I may even start entering the silver markets through the futures contracts, or perhaps such as stocks like the SLV, which offers not only exposure to the futures markets as involving silver, but several silver related publicly traded companies as well. In other words, it spreads risk around the silver world in general.

Ultimately though, I believe that the CFD markets could also work, and a have no interest in buying the summer markets in general. It is not until we closed well below the $18.50 level that I would consider selling with any serious amount of money. Ultimately, I think that the market heads back to the $21.50 handle.