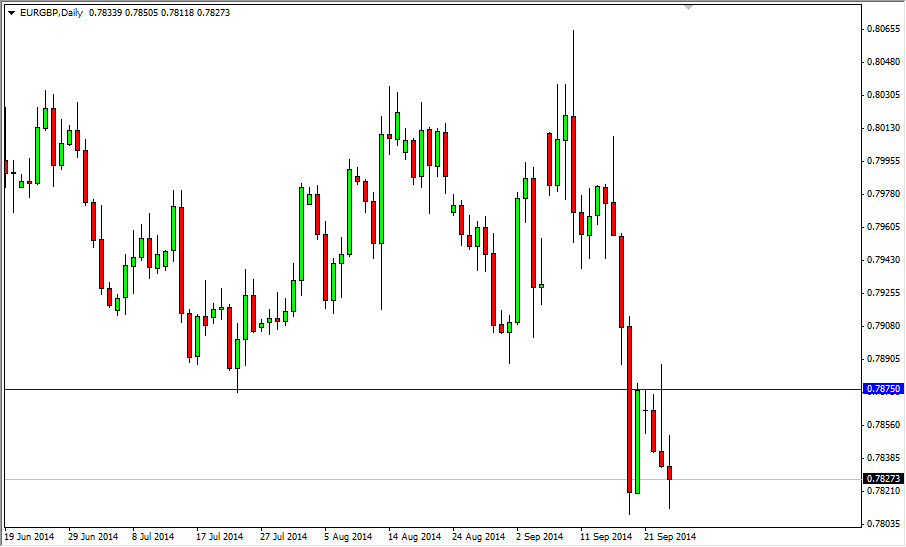

The EUR/GBP pair went back and forth during the course of the day on Wednesday, essentially hovering just above the 0.78 handle at the end of the day. The 0.78 level has been supportive in the past, and as a result we need to break down below there in order to have any significant short position in this marketplace. On the other hand, it’s difficult to buy this market because the 0.7875 level above is so resistive. In general, this market looks like it’s ready to consolidate in this area, but we do certainly have more of a downtrend than an uptrend, so I think that we break down below the 0.78 handle, I am much more comfortable with that move than buying on a break out above.

The Euro continues to weaken against almost everything else, and I believe that we break down significantly below current levels in the EUR/USD pair, that could be even more downward pressure in this pair as that type of weakness should continue to travel over into this market.

The trend is far too strong to fight at this moment.

I personally believe that the trend is far too strong at this moment to be bothered fighting. Furthermore, I think that even if we get above the 0.7875 resistance barrier, there’s so much noise between there and the 0.8050 level that I think the market will be very volatile and should shakeout a lot of so-called “weak hands.”

The British pound does look like it’s trying to pick up a little bit of strength against the US dollar overall, meaning that it should be continuing its strength against the Euro and many other currencies. After all, the US dollar has been favored against almost everything else, and the fact that the British pound could hold its own against the US dollar suggests that it has quite a bit of underlying strength. Because of that, I think it’s only a matter of time for this market breaks down significantly and the Euro weakness continues to weigh upon this pair overall.