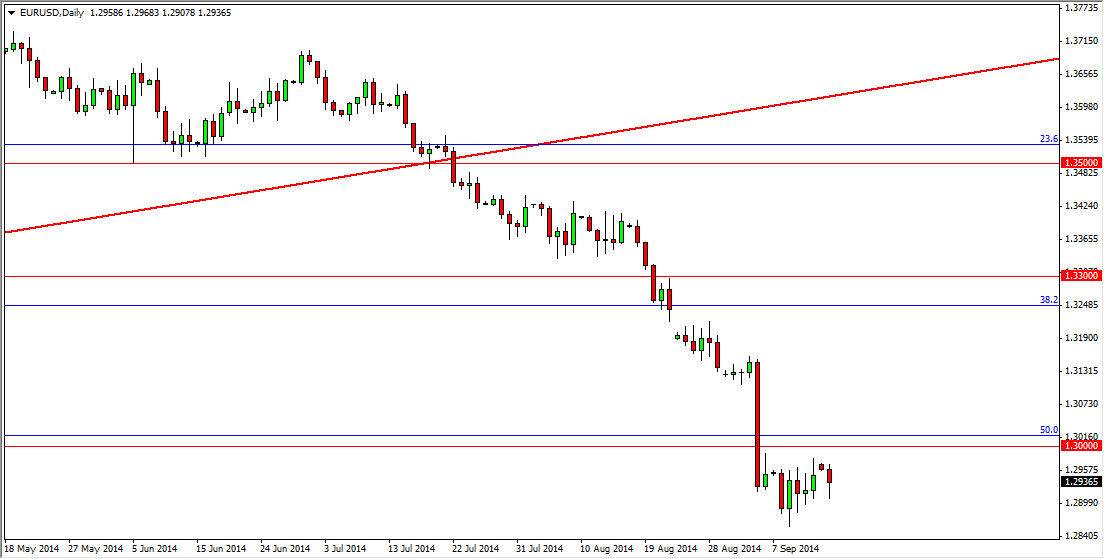

The EUR/USD pair initially fell during the course of the day on Monday, but turned back around to form a nice-looking hammer. This hammer of course suggests that there are buyers underneath, and we could pop a little bit higher. However, I feel that the 1.30 level looks a bit resistive, and it is not until we get above there that I feel this market can be bought. Above there, the market then goes to the 1.32 level in my opinion as the resistance will have been broken. That area extends all the way to the 1.3250 level, as the gap in that region should offer plenty resistance.

I do believe however that we could go lower, so obviously if we break the bottom of the hammer, I would have to stand up and take notice. However, the 1.28 level below should be plenty supportive, so it’s difficult to imagine that the markets are going to do anything drastic until we get below there. Below that level however, this market gets a very ugly, very quick.

Oversold conditions.

By just about any metric you measure this market on, it looks as if it is oversold. I’m not calling for the Euro to suddenly strengthen, just that the selling may subside a little bit as the world is focusing more on the British pound them the Euro at the moment anyway. If you have traded this pair for any real length of time, you know that the market tends to go back and forth as to whether or not it is focusing on the market at the moment. Simply put, sometimes we are paying attention to all the bad things in Europe, and other times we are paying attention to all the bad things in the United States. Neither economy is exactly anything worth writing home about, but between the two, the United States is most certainly doing better. I think that you will have a nice opportunity to sell the Euro at higher levels, but in the short-term we probably will see strength in this market.