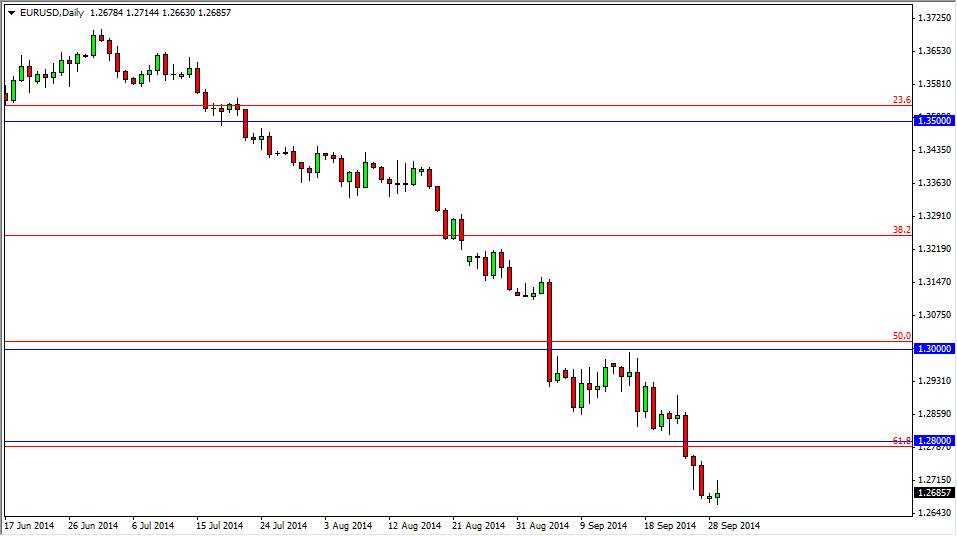

The EUR/USD pair tried to rally during the day on Monday, but as you can see failed at the 1.27 level. The resistance at that area caused a shooting star to form, which of course is a fairly negative candle at the bottom of a downtrend. If we do bounce from here, I believe that the 1.28 level will be resistive, and I know that the 1.30 level will be resistive. There should be plenty of selling pressure between here and 1.30, so having said that I have no interest whatsoever in buying the Euro.

I think that a break below the bottom of the shooting star is another reason to sell, as the European Central Bank still looks likely to loosen its monetary policy, and the European Union struggles with deflationary pressures. Ultimately, the longer-term charts suggests that we could go as low as 1.20, but in the meantime I think that the next logical target will be the 1.25 handle. I think that any move below there is going to take significant time, as the Euro tends to have “nine lives”, and with that I am cautiously optimistic on each short position I put on.

King Dollar.

The US dollar continues to be the favorite currency of traders around the world, and remains King at the moment. I don’t see any hope of selling the US dollar in general, as it continues to strengthen overall. This is true against the Euro, just as it is against the Yen, and the Canadian dollar.

The Euro will continue to suffer a lot of pressure to the downside against most other currencies, and as a result we look at this pair as not only a viable shorting opportunity, but a barometer for other such currency pairs such as the EUR/CAD, the EUR/TR wide, and the EUR/GBP pairs. With that being the case, I am very bearish of the Euro, but do recognize that we have sold off so much over the last several months that we could see a significant bounce suddenly in this particular market, but I still believe that any rally invites sellers.