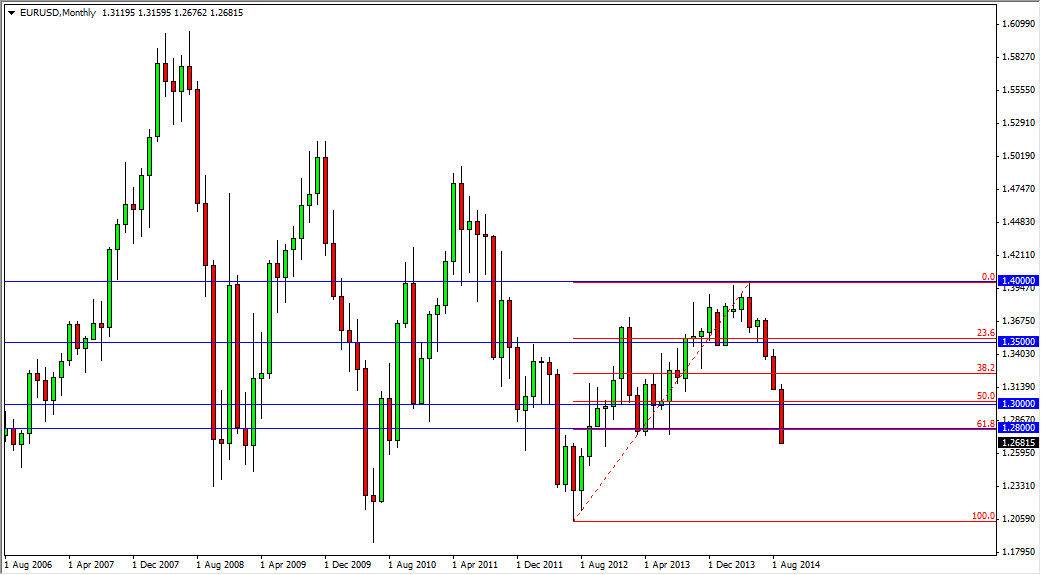

The EUR/USD pair fell hard during the course of the month of September, slicing through 1.28 with absolutely no trouble whatsoever. Because of this, I think that this market continues to fall and I even believe we go as low as roughly 1.20 level given enough time. With that, I am selling rallies as they appear, as this market is completely broken. The fact that we are closing towards the end of the month at the very lows of the candle tells me that the market certainly has a lot of negative connotations to it, as the US Dollar has become one of the few games in town.

Ultimately, I think that shorter-term traders will find this a very profitable market as they will be able to sell and sell again. Longer-term traders will probably have to deal with quite a bit of volatility all the way down there, but at the end of the day I don’t think there’s any other alternative.

European Central Bank

The European Central Bank should continue to ease its monetary policy going forward, just as the Federal Reserve should continue to tighten its monetary policy. If we continue this route, there’s no way whatsoever that this market can do anything but fall. After all, the Federal Reserve is tightening its monetary policy via cutting out the quantitative easing that the market has been getting used to. After all, the interest rates in the United States are almost nothing, which of course doesn’t help the value the US dollar.

That being said, I believe that the interest-rate differential will continue to head back towards the United States and with that we should see something more along the lines of parity going forward. I’m not calling for a parity exchange rate, but I do recognize that we are far overvalued still and Brussels once a lower exchange rate at this point in time. With the German economy starting to show signs of slowing down, there’s no reason to think that this market will continue to go much lower.