GBP/USD Signals Update

No signal was given yesterday.

Today’s GBP/USD Signals

No signal is given today.

GBP/USD Analysis

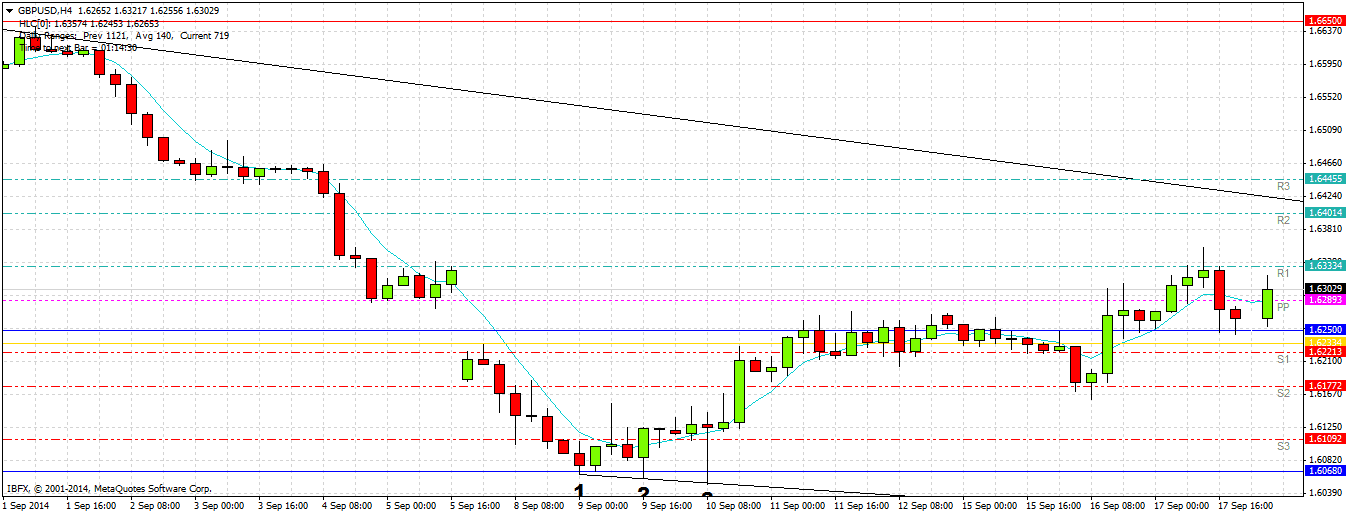

I wrote yesterday that a good confirmation of the current bullishness in this pair would be a break aboe 1.6330. We did get 20 pips or so past that level yesterday, but we were not able to maintain it for long, and we are now back down below.

What is really going on with this pair, is that it is a case of strength vs strength, which is why we are not getting much movement. The USD is very strong and over time is the strongest currency right now. However, over the last day or so, the GBP has been the strongest currency. They are each great currencies to trade for direction right now, just not against each other. Both have been racing ahead against the JPY, the GBP even more so that then USD.

Yesterday's UK economic data were good for the GBP, but as I also wrote, what is most important of all to the health of the GBP at least in the short term, is whether Scotland votes No to independence today. Although the polls are quite tight, they do show No in the lead by a few points, and the bookmakers are offering odds at only 20% of the stake on No winning. Adding these factors to the fact that the GBP has been strengthening as we approach the voting, is enough to conclude that the smart money is expecting a No vote. This would probably lead to the GBP strengthening even more. It is important to consider that an extremely high voter turnout is expected, so there might be a surprise. Results will not start to come out until about 2am London time.

Due to all these factors, it is quite hard to spot a trade in this pair today, you might want to be watching GBP/JPY or USD/JPY or AUD/USD instead. Nevertheless, the bearish trend line in the chart below currently at around 1.6420 is likely to provide some kind of reaction when it is touched, especially after a spike.

There is support which has been flipped from resistance at 1.6250 below.

There are several high-impact events scheduled today concerning both the GBP and the USD. At 9:30am London time there will be a release of U.K. Retail Sales data. Regarding the USD, at 1:30pm there will be releases of US Building Permits and Unemplyment Claims data. At 1:45pm the Chair of the Fed will speak and then at 2:00pm there will be a release of the Philly Fed Manufacturing Index. As mentioned, later tonight there will results from the Scottish referendum. It is likely to be an extremely volatile day for this pair.