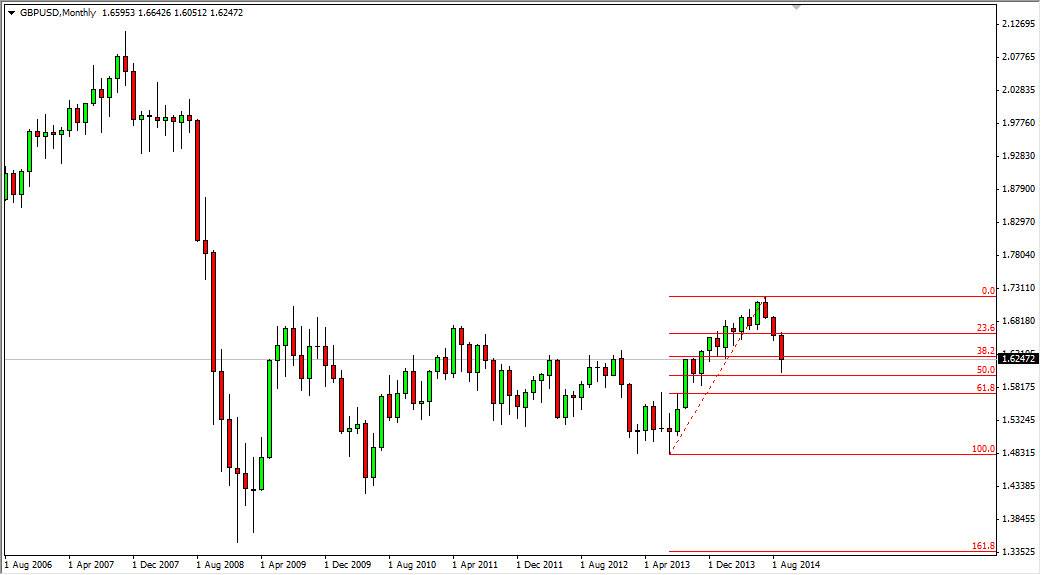

The GBP/USD pair has been falling for some time, but on the weekly chart we did see a hammer form at the 50% Fibonacci retracement level from the move that started a year and a half ago. This market looks as if it’s ready to bounce from here, and there is certainly a large amount of support below and noise to say the least. With that, it appears that the market should continue to go higher, as the 1.73 level at the highs should be the target going forward, and I believe on top of that we should eventually break above there.

I believe that pullbacks will continue to offer buying opportunities in this pair, and by the end of the month I would not be surprise at all to see this market go to the 1.70 handle. The market is highly favorable for the US dollar overall, but the British pound is the one outlier that I see. The Bank of England may have to tighten sooner than people had anticipated, and there have been words to that effect. Because of this, this is the one market that might move countercyclical to everybody else.

Longer-term uptrend?

The beauty of this chart is that if we can start going higher again, there really is nothing to stand in the way of going to the 2.00 level. Obviously, that would take a very significant amount of time, but I believe that we are getting very closely to a “buy-and-hold” type of marketplace. We will have to see what happens in the near term, but I think if you have the ability to hang onto to the position, you could end up making quite a bit of money in this pair. Because of this, I am not looking at it as a short-term trading opportunity, but one that is more of a longer-term investment type of setup. I think that the move might become of slow, but bullish momentum should be building up. With that in mind, I have no interest in selling this market at all.