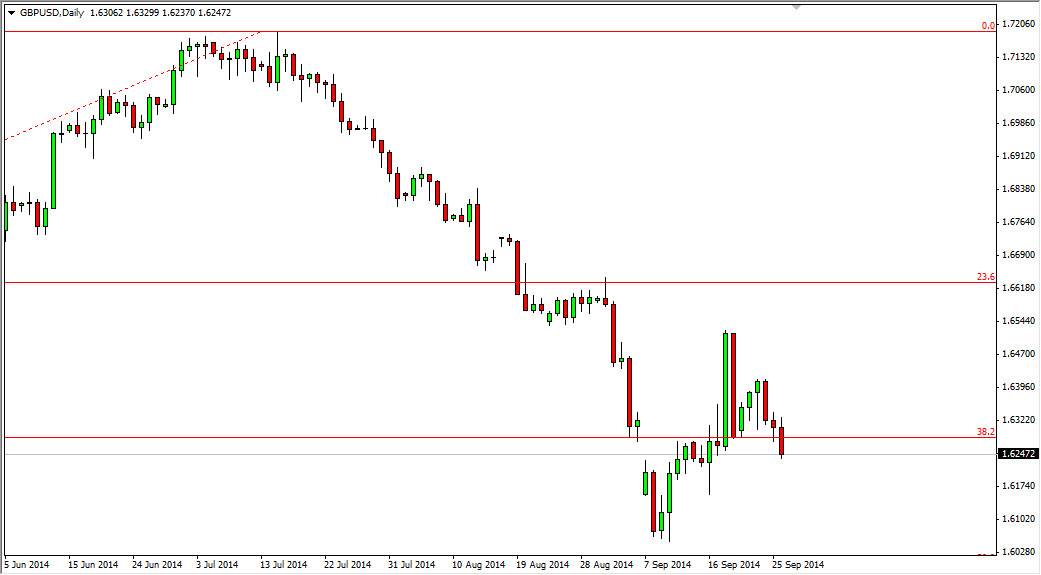

The GBP/USD pair initially tried to rally during the session on Friday, but turned back around to break below the 1.63 handle. However, I see the 1.6250 level as the area that we need to pay attention to the most, as it is the area that the market gapped below a couple of weeks ago. With that, there should be a bit of a natural support area here, and as a result I am actually looking for some type of supportive candle in order to start buying.

The market bouncing from here wouldn’t be as big of a surprise as it appears on this chart. After all, the weekly hammer that formed a couple of weeks ago was right at the 50% Fibonacci retracement level, as well as just above the 1.60 handle. With that, I think that there is a significant chance that we will continue to go higher, but it will certainly be difficult going higher. After all, I see quite a bit of noise just above, and with that there will be choppiness to say the least.

Being choppy would be normal.

This market being choppy after this type of action wouldn’t be that big of a surprise, after all it is a little bit of a trend change, at least the intermediate trend. There is a certain amount of trepidation when it comes to placing a trade after this type of sell off, but when you look at the larger move, it’s not a big surprise that the so-called “smart money” would be trying to enter in this particular region.

While the US dollar is of course one of the more favored currencies out there, the fact is that the Bank of England may have to start tightening its monetary policy much quicker than some of the other central banks around the world as well, so having said that I believe that this is probably the one outlier as far as trading against the US dollar is concerned. However, I do recognize that we break down below the 1.62 handle, we are more than likely going to test the 1.60 level again.