The XAU/USD pair suffered a weekly loss of nearly 1.25% as the conditions in the marketplace continued to diminish desire for safe-haven diversification. Speculations that the U.S. Federal Reserve is moving toward raising interest rates, along with the perception that Chinese gold demand is faltering have been weighing on gold prices for the last couple months. A lot of the geopolitical concerns have dissipated and the combination of that with good U.S. economic data is pushing money into the dollar and equities.

Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 72187 contracts (the lowest level in fourteen weeks), from 95141 a week earlier. I think the risk on attitude will have a negative impact on the precious metal but apparently the bearish side of the boat is getting overcrowded. However, that doesn't change the fact that the path of least resistance for gold appears lower.

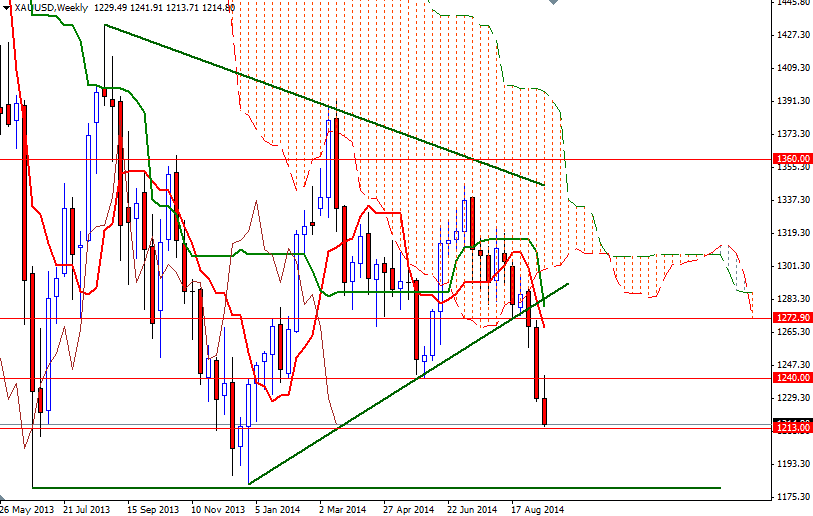

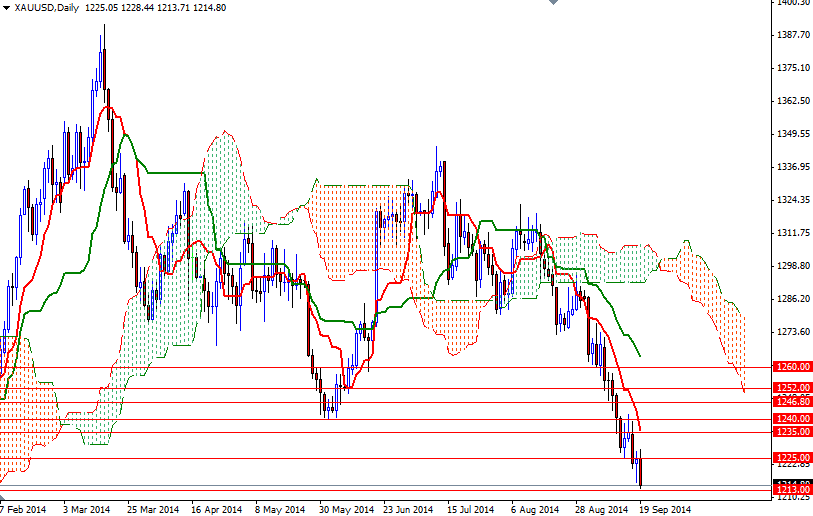

Speaking strictly based on the charts, the weekly and daily charts suggest that the directional bias remains weighted to the downside. Basically the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. At this point, the key levels to watch will be 1213/1 and 1225. If the 1213/1 support gives way, then the next possible targets will be 1208 and 1200. Closing below the 1200 level would make me think that a retest of 1182 is on the table. If the support around 1213/1 remains intact and prices start to climb, expect to see some resistance between 1222 and 1225. In order to gain some traction and revisit the 1235 level, the bulls will have to force the market back above the 1227.55 resistance on a daily basis.