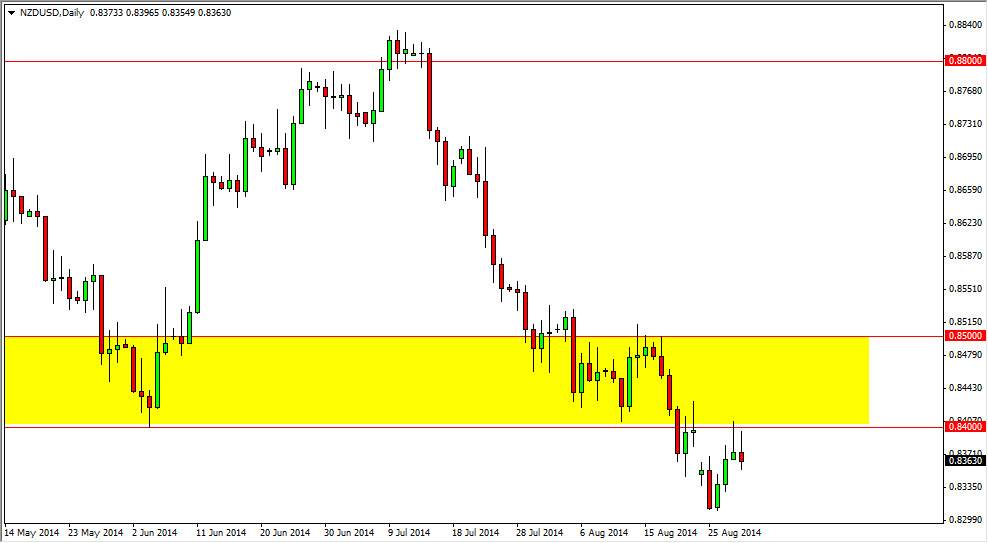

The NZD/USD pair tried to rally during the session on Friday, but found the 0.84 level be far too resistive. Because of that, the market turned back around and formed a shooting star for the second day in a row, a very bearish sign. On top of that, the gap offered enough resistance to catch most market participant’s attention as well, so I believe that the market is ready to start selling off again and aiming for lower levels. The 0.83 level below is supportive, so I think that this will be the target for the sellers in the short-term. Whether or not we can break down below there of course is a completely different question, but I think there is a bit in the way of noise below based upon longer-term charts, and that of course could be difficult to overcome.

On the other hand, everybody loves the US dollar.

It appears that the US dollar will continue to reign overall, at least according to the US Dollar Index. It has broken out, and it now appears that the US dollar itself is a “one-way bet.” Because of that, we could very well break down below the supportive level below, but it is going to be a bit of a fight. Because of this, I think that the market will more than likely drift lower, but it will do so any choppy manner all the way down.

On the other hand, if we break out to the upside and above these two shooting stars, we could reenter the consolidation area between the 0.84 level and the 0.85 handle. With that being the case, the market could very well bounce around in that area if we do break out to the upside. However, I’m not interested in buying this market until we get above the 0.85 handle, which would represent a massive change in momentum. That being the case, the markets will be bullish at that point, but that is the least likely of scenarios in my opinion at this point in time.