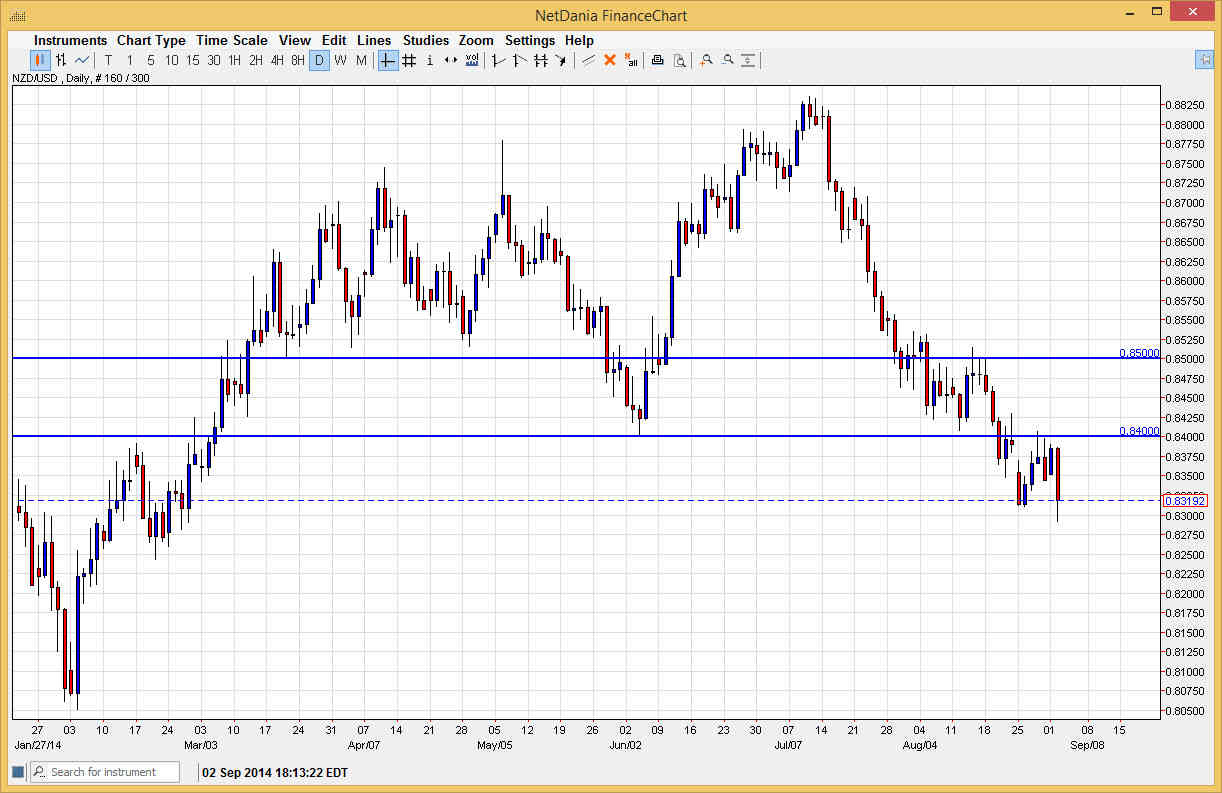

The NZD/USD pair fell during the course of the day on Tuesday, smashing into the 0.83 handle. That level offered support though, as we bounced from there. At the end of the day though, I believe that the market will continue to go down from here, especially as the commodity markets all look so soft. I believe that this is a lot like many of the other markets out there, that it is simply buying the US dollar every time it depreciates is the strategy. I think that rallies will continue to find sellers, and that we will ultimately head to the 0.8050 level.

With the US economy being the strongest of the major economies at the moment, it makes sense that the New Zealand dollar will continue to fall against it, as so many traders are looking to pick up the greenback every time they can. This market is most certainly in a downtrend at this point in time, and as a result I have absolutely no interest in going long of this market.

Continued bearish pressure.

I think that we will see continued bearish pressure in this marketplace, as we continue to see the commodity markets get punished by a stronger US dollar. The US Dollar Index has broken out to the upside, and still has quite a ways to go before it hits its potential target. With that, I believe that the US Dollar will continue to be the favored currency, and traders will of course shone any serious amount of risk such as buying the New Zealand dollar which of course is highly correlated to the commodity markets overall.

On top of that, the Australian economy seems to be sputtering a bit, and with that the New Zealand dollar will more than likely move in sympathy. After all, the two economies across the Tasman are very interconnected, and as a result one currency will typically mimic the other. The Australian dollar looks sick, but the New Zealand dollar looks even worse at this point in time.