Version:1.0 StartHTML:0000000167 EndHTML:0000003164 StartFragment:0000000457 EndFragment:0000003148

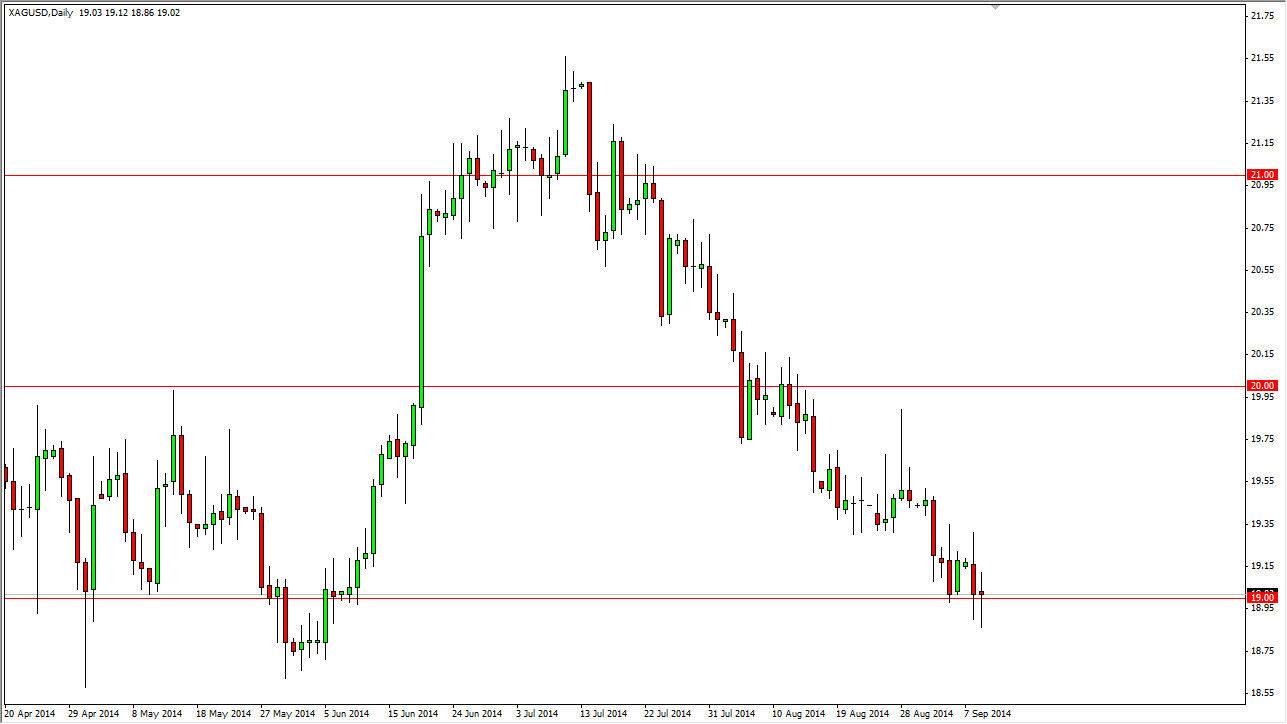

The silver markets did very little during the session on Tuesday, as we continue to slam around the $19.00 level. The resulting candle is a very neutral candle, and as a result I think the $19.00 level will continue to attract buyers. The $18.80 level below is the beginning of serious support, and it is not until we make a fresh, new low at this point in time that I am willing to sell silver.

Personally, I have been buying physical silver recently in order to make a significant amount of money longer-term. I believe silver will go much higher given enough time, but we may have a great flush coming soon. If we get the fresh, new low, it’s very likely that we will probably go to the $15 level, or perhaps even the $13 level. If we fall that low, I am going to absolutely “load the boat” with physical metal.

A bounce is very possible.

I believe that a bounce is very possible at this point in time, and if we break the top of the candle from the Tuesday session, we will more than likely head to the $19.50 level, and then possibly the $20.00 level. That area is significant resistance though, so I don’t expect to see this market get above the $20 level anytime soon. If we get above there, the trend will more than likely change overall.

That being said, the reality is that it’s going to be much easier to buy silver at this point than sell it. However, if we break down below the lows back in May, I think that the market will be an easy sell, and I will be selling leveraged instruments such as futures contracts. However, I’m the first to admit that I would still be buying physical silver as a dress lower. That is more or less a type of investment as far as I can see, and the futures and CFD markets would be more of a trade. In a sense, I am playing both sides of the fence if we break down.