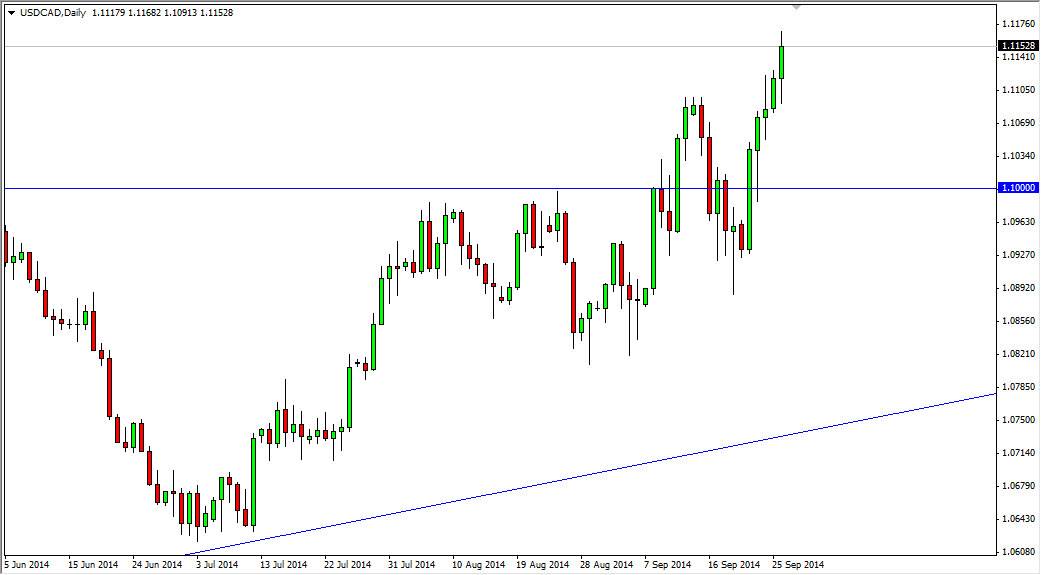

The USD/CAD pair initially fell during the course of the day on Friday, but as you can see ended up going higher during the day. The 1.1150 level was broken above, but it seemed to offer little bit of resistance before the end of the day came. The 1.12 level above is my target for longer-term trading anyway, and it appears that we are going to hit that fairly soon.

The 1.12 level should be resistive, but at the end of the day I believe that pullbacks should offer buying opportunities going forward. After all, the trend is fairly strong and the oil markets certainly are doing nothing to help the Canadian dollar. The Canadian dollar doesn’t always follow the oil markets, but it most certainly does in general over the long-term. Because of this, I don’t feel that there is a whole lot to push the Canadian dollar higher in value, especially the US dollar.

Longer-term uptrend.

I believe that we are in a longer-term uptrend that started several months ago. With that being the case, the market should continue to offer buying opportunities every time we pullback. The 1.10 level has been a magnet for price recently, and I think it should offer quite a bit of support going forward. Going all the way down to the 1.08 level, I see plenty of support and therefore supportive candles will be purchased. I have no interest whatsoever in selling this market, because I am very hesitant to start selling the US dollar, as it is so strong against so many other currencies.

Commodity currencies in general are doing very poorly against the US dollar, and I think the Canadian dollar won’t be any different by the time it’s all said and done. With the New Zealand dollar and the Australian dollar both being broken down rather viciously, I think that this should transfer into strength in this pair for quite some time. In fact, I believe that we will eventually break above the 1.12 level, and then head to the 1.15 level.