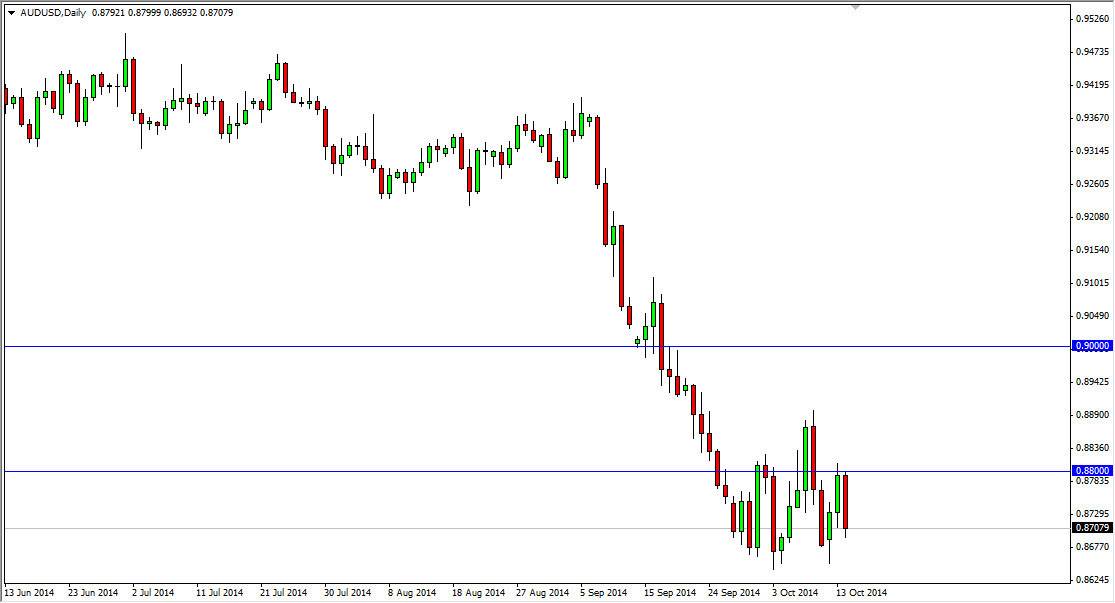

During the session on Tuesday, the Australian dollar fell again. However, at this point in time it appears that the market is ready to consolidate, at least in the short-term. The overall trend is most certainly to the downside, and the gold markets don’t look very healthy at this point in time. The Australian dollar continues to look susceptible to the US dollar and other currencies as the Royal Bank of New Zealand recently suggested that the Kiwi dollar was a bit too expensive. As the two currencies tend to move incongruence, I have to believe that the Australian dollar will have continued bearishness in its future.

The gold markets are struggling at the $1240 level, an area of significant resistance. Because of this, I believe that the Australian dollar will continue to have issues. However, looking at the currency chart itself I believe that we need to get below the 0.8650 level in order to start selling again. A bounce from here will more than likely attract more selling pressure at the 0.88 level, an area that has continued to see selling pressure.

0.80

I believe that ultimately this market will probably go as low as 0.80 based upon recent economic developments around the world. The US dollar continues to strengthen, and I believe that the US Dollar Index will head to the 90 handle, which should be massively bearish for this pair. Ultimately, I think we will see the “mother of all bounces” at the 0.80 handle, and possibly even as high as the 0.85 level, which is my minimal target at this point. However, I believe that the longer-term charts suggests that the 0.80 level will be the area where the market tries to get to, and at this point in time it’s difficult for me to imagine a scenario in which I serve buying the Australian dollar.

That being said though, if the gold markets close above the $1250 level on a daily close, we could see the Australian dollar strengthen. I am not a buyer though until we get above the 0.9050 level.