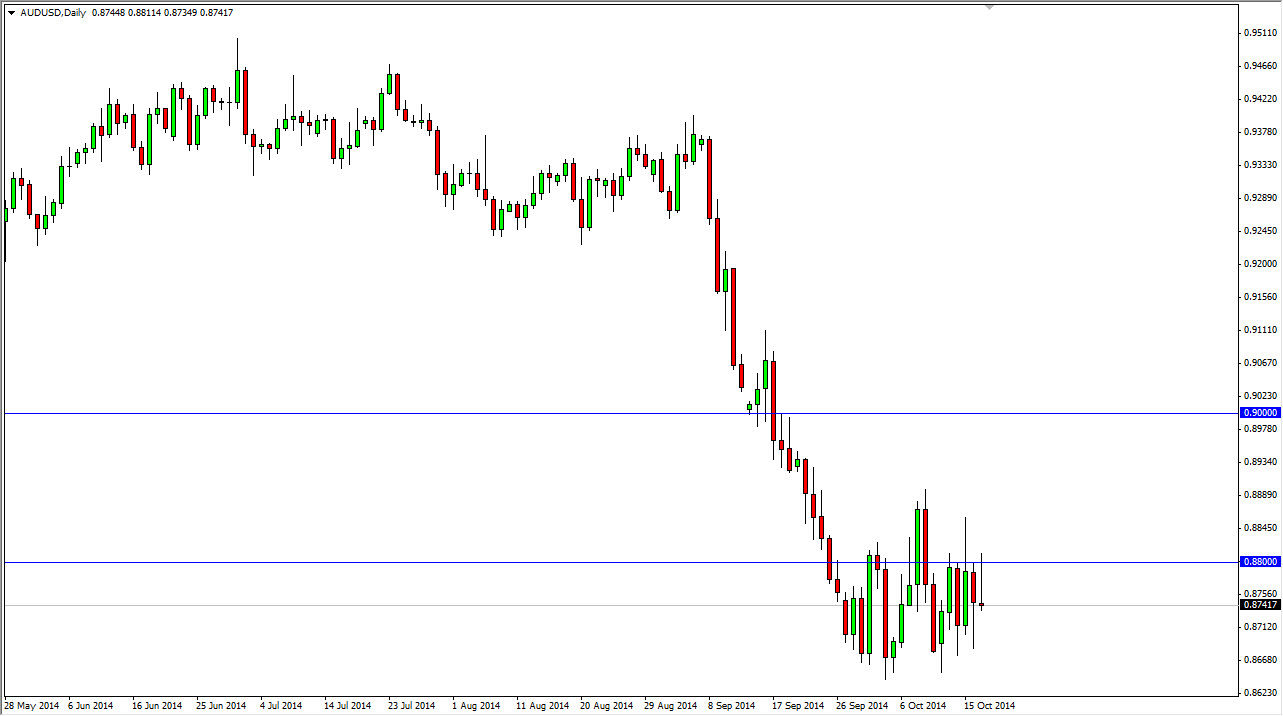

The AUD/USD pair failed at the 0.88 level on Friday again, and this only in my opinion strengthens the idea of the Australian dollar continuing to lose strength. On top of that, you have to keep in mind that the gold markets aren’t exactly blistering hot right now, and that of course cool some of the demand of for the Australian dollar in general. With that being the case, I believe that the Australian dollar will continue to see sellers every time it rallies, and I feel that there is a significant amount of resistance all the way to the 0.9050 handle. The clustering that we’ve seen recently isn’t quite a bearish flag yet, but it is starting to look like one.

I believe that the 0.8650 level offers support but if it gets broken to the downside that would be a significant sign that the market is going to continue lower, probably heading to the 0.85 handle. I also have to admit that the longer-term charts are telling me we could even go as low as 0.80, an area that has been attractive to the market time and time again over the last several decades.

New Zealand could have an influence as well.

One of the things that could be working against the value the Australian dollar is the fact that the Royal Bank of New Zealand has been interfering in the value of the Kiwi dollar lately as well. They’ve been selling it off, and they anticipate that a “fair value” for the currency is 0.68 against the US dollar. That means there has to be quite a bit of selling in the Kiwi dollar going forward, and we all know that the two currencies tend to influence each other in general. With that, I think there are plenty of reasons to believe that the Australian dollar will continue to get weaker over the next several weeks if not months. If we did break above the 0.950 level, at that point in time I would start to reassess the market.