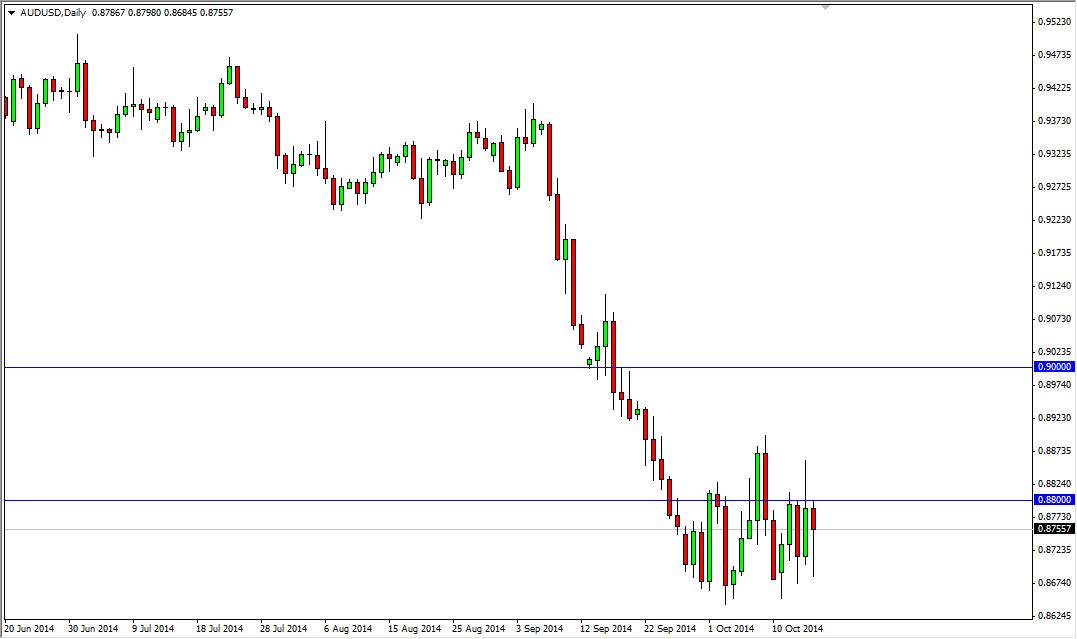

The AUD/USD pair fell during the session initially on Thursday, but found enough support below to turn things back around and form a nice-looking hammer. This hammer of course suggests that the market is going to try to break out to the upside but there is still plenty of noise above to keep the market down. On top of that, we are most certainly in a downtrend, and as a result I don’t like buying the Aussie into we have a clear breakout.

For me, the clear breakout will be somewhere near the 0.9050 level, and until then I would consider this within the realm of negligence when it comes to the downtrend. On top of that, I also recognize that the RBNZ in New Zealand is working against the value the Kiwi dollar, and as a result there might be a bit of a knock on effect over here in the Aussie.

Messiness

Looking at this chart, I see nothing but messiness near the 0.88 level. Because of this, the market looks as if it is simply going to bounce around in this fairly tight consolidation range, which of course makes sense when you look at the gold market. The gold market has broken out above the $1240 level, but still struggles in the general vicinity. With that being the case, I find it very difficult to imagine that either gold or the Aussie will take off in one direction or the other anytime soon. I think there is a lot of noise to be worked through, and it during today’s session I think a lot of traders will be hesitant to put on fresh new positions into the weekend.

I think that this market will eventually head down to the 0.85 level, but it’s not going to be an easy move. I prefer to sell rallies the show signs of resistance as opposed to buy pullbacks and show signs of support. With that being the case, I believe that ultimately the market falls but it’s going to take quite a bit of wherewithal to hang on.