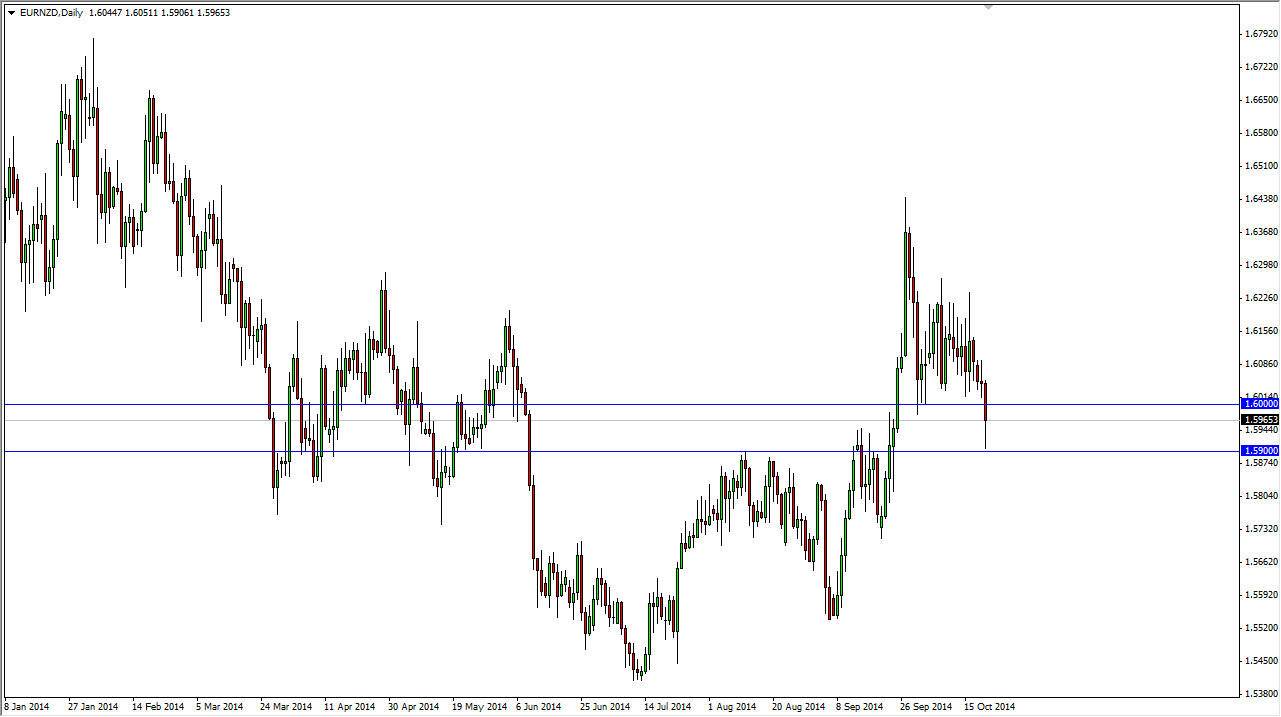

The EUR/NZD pair fell during the session on Tuesday, slamming into the 1.59 level. With that, it appears that the market is testing a large support region that could influence the longer-term move of this marketplace. While I am particularly bearish on the Euro, the fact is that the New Zealand dollar is a little bit of an anomaly in the sense that it has a central bank that has actually stepped into the Forex markets recently and sold it off. That’s right, the Royal Bank of New Zealand has actually stepped into the NZD/USD pair in order to drive down the value of its own currency. Presently, that market is testing the 0.80 handle, but the Royal Bank of New Zealand has suggested that it was much more comfortable with a price of 0.68 to the US dollar. In other words, they believe that it is highly overvalued.

With that being said…

With that being said, I think that this market will be a bit different than many of the other ones in the sense that the Euro could probably gain strength. If we can get back above the 1.60 handle, I feel that this market will probably head back to the 1.62 level over the course of the next couple of sessions. Obviously, we have seen a significant amount of support at the 1.59 level, which has been pretty significant resistance previously. On top of that, if the NZD/USD pair start falling, I think that will outweigh whatever happens in the EUR/USD pair in order to influence what happens here. The Euro doesn’t look like it’s in danger of a massive freefall, but I certainly cannot say the same thing about the New Zealand dollar overall.

On top of that, keep in mind that the New Zealand dollar is highly sensitive to the commodity markets, and there’s very little going on in the commodity markets right now that would have me excited. With that, I think that the New Zealand dollar continues to depreciate overall, and this market will be the difference of therefore I am bullish but need to see that break above 1.60 in order to start acting on that bias.