The EUR/USD pair went back and forth during the course of the day on Wednesday, testing the 1.26 level, but not making any significant movement below or above it. Because of this, I believe that the market is essentially waiting on a couple of different announcements before it makes its next move, with the most obvious one taking place today.

The European Central Bank has an interest rate decision today, and with that I feel that this market is simply waiting to see what happens. I do not believe that this market expects any type of rate cut, that certainly would be very negative, as we are already at 0.05% at the moment. However, it will be the question and answer bit of the press conference after the first rate announcement that will be parsed and looked at quite closely by the trading community.

Future expectations

Looking forward to have the potential future expectations is exactly what this market is going to do. After all, the Federal Reserve certainly looks ready to continue tightening its monetary policy by exiting ligated easing altogether. By doing so, it essentially will force interest rates higher, while the European Central Bank may be on a completely opposite path at the moment. After all, they are suggesting that perhaps buying sovereign bonds is going to happen, and if it does that should drive down the value of the Euro due to the fact that the bond yields will continue to shrink.

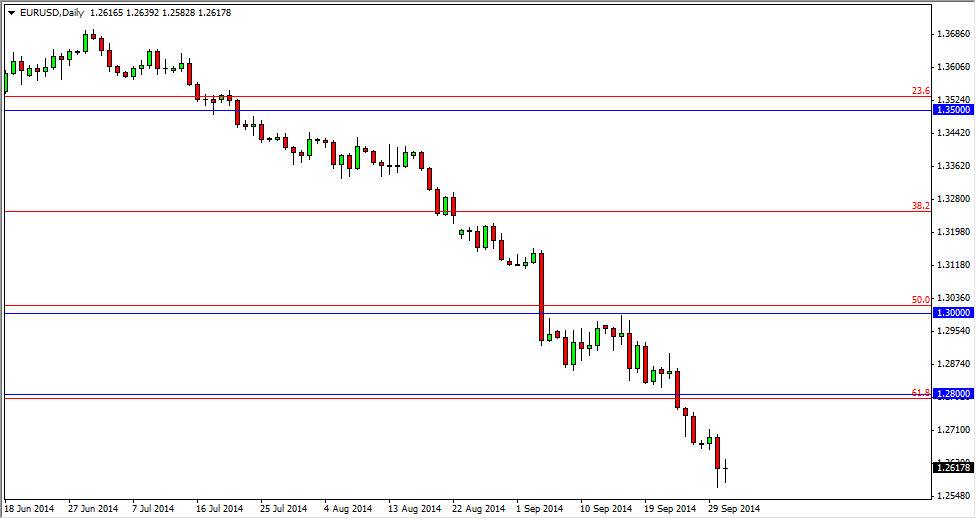

All things being equal, it appears to me that the 1.28 level above should be rather resistive, and with that I would be a seller of any rally towards that area. On the other hand, I believe that the 1.25 level below is rather supportive, and as a result it is difficult to short on a break below the recent low, which I see as 1.2550 or so. In other words, the risk to reward ratio isn’t that good unless we get some type rally. At that point time though, I won’t hesitate to start selling. I do not have a scenario in which I buy this market right now.