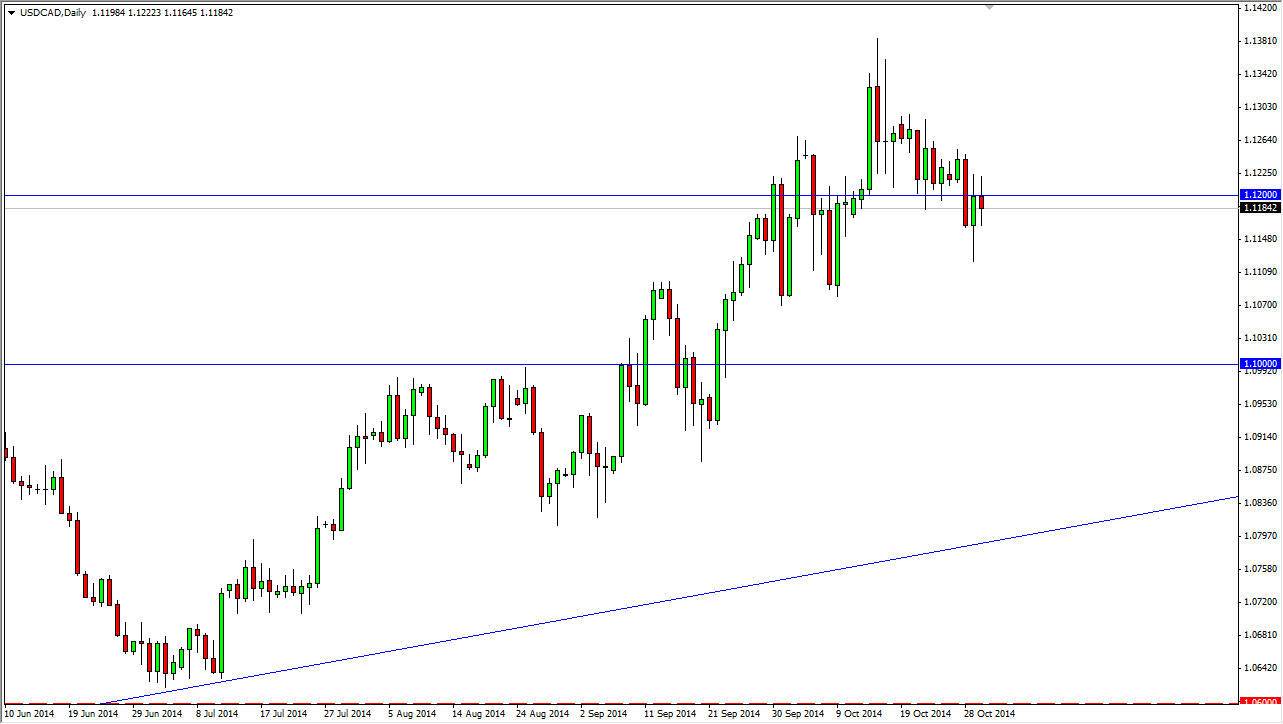

The USD/CAD pair went back and forth during the day on Thursday, as it continues to hang about the 1.12 handle. This is an area that has attracted a lot of attention lately, and I believe it will continue to do so. After all, we have seen a couple weeks of support just broken at that area, which previously had been resistance for the couple weeks before that. Because of this, I think that the market will continue to be very volatile but I also recognize that the oil markets are not giving any support to the Canadian dollar.

With the Canadian GDP numbers coming out today, I think that we could see a little bit of volatility in this market. If we can break the highs from the last couple sessions, I would be a buyer of this pair as we are most certainly in an uptrend recently. I don’t really have much of an argument for selling this market, because I believe there are so many minor supportive areas between here and 1.10, it just simply isn’t worth the hassle.

US dollar remains King

I believe that the US dollar will remain King, and although the Canadian dollar has the benefit of being a North American currency, is still play second fiddle to the US dollar as far as the global economy is concerned. Ultimately, it’s going to take some help from the oil markets in order for the Canadian dollar to strengthen against the US dollar, and I just don’t see that happening anytime soon. In fact, it would not surprise me at all to see this market move to the 1.14 level, and then possibly the 1.15 level over the course of the next couple of weeks.

Keep in mind that this pair tends to grind sideways for long periods of time and then make sudden impulsive moves, which of course is a sign of the two intertwined economies. After all, the Canadians send 85% of their exports down to the United States, which of course means that there’s no way to separate one currency on the other. Ultimately though, higher levels are what I’m looking for.