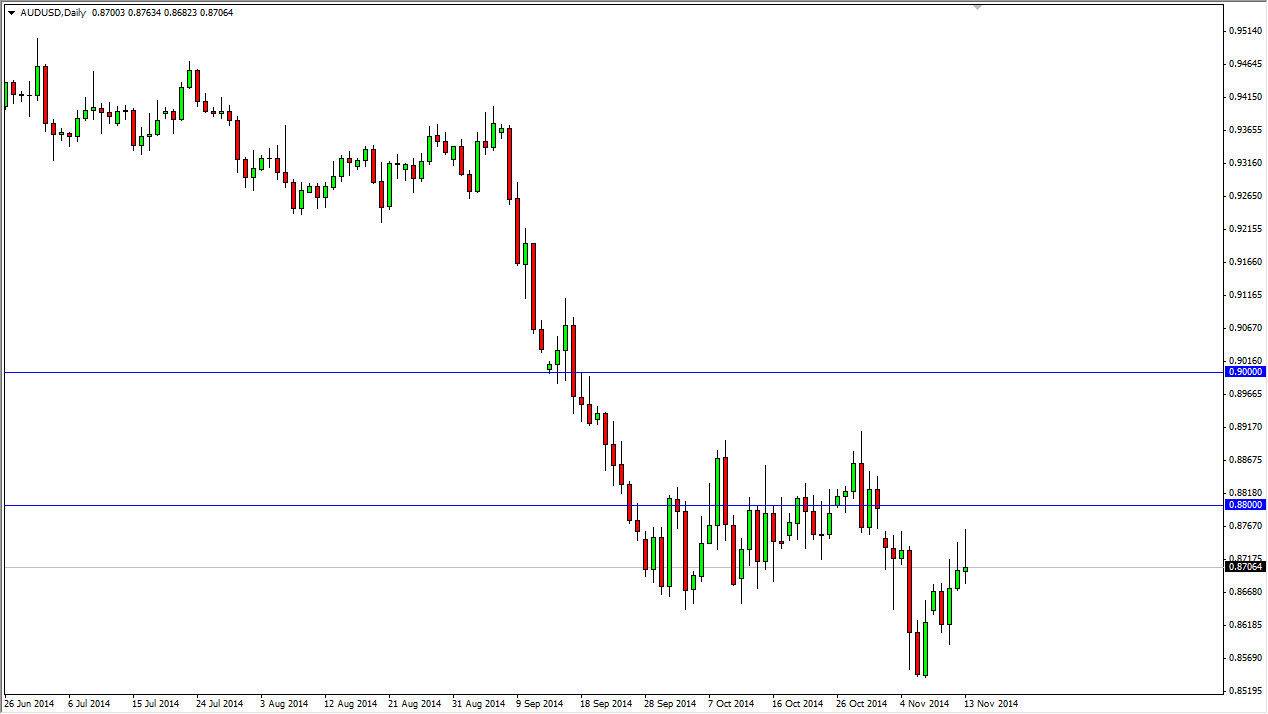

The AUD/USD pair tried to rally during the session on Thursday, but as you can see struggled to keep the gains above the 0.87 handle. That being the case, the market ended up forming a massive shooting star, and it looks as if the market is ready to return to the downtrend that we had seen for so long. Ultimately, this market will more than likely head to the 0.85 handle given enough time, and I am more than willing to sell it on a break below the bottom of the aforementioned shooting star. After all, the market looks as if it is ready to continue going lower and the gold markets certainly are doing the Australian dollar any favors at this point in time.

The city the candles also perfect, so that doesn’t hurt my opinion of shorting this market any either. I think that this market will ultimately break down below the 0.85 handle, just as I believe that the gold markets are going to fall rather significantly. Because of this, I am very bearish of the Australian dollar as it seems to have no help at the moment.

The US dollar

The US dollar is without a doubt the strongest currency that I am following right now, and it should continue to be. The market looks ready to continue to move in favor of that currency, which makes a lot of sense considering that the Federal Reserve is leaving the quantitative easing game. This has a massive effect on this market simply because it not only works against the value of the Australian dollar due to the fact that the US dollar is appreciating, but it also drags down the value of gold. In other words, it’s a bit of a “double whammy.”

I think ultimately the 0.88 level was always going to be a bit too resistive, and with that the market was never really going to go to much higher than we see it right now. That being said, I am very bearish of the Aussie at this point.