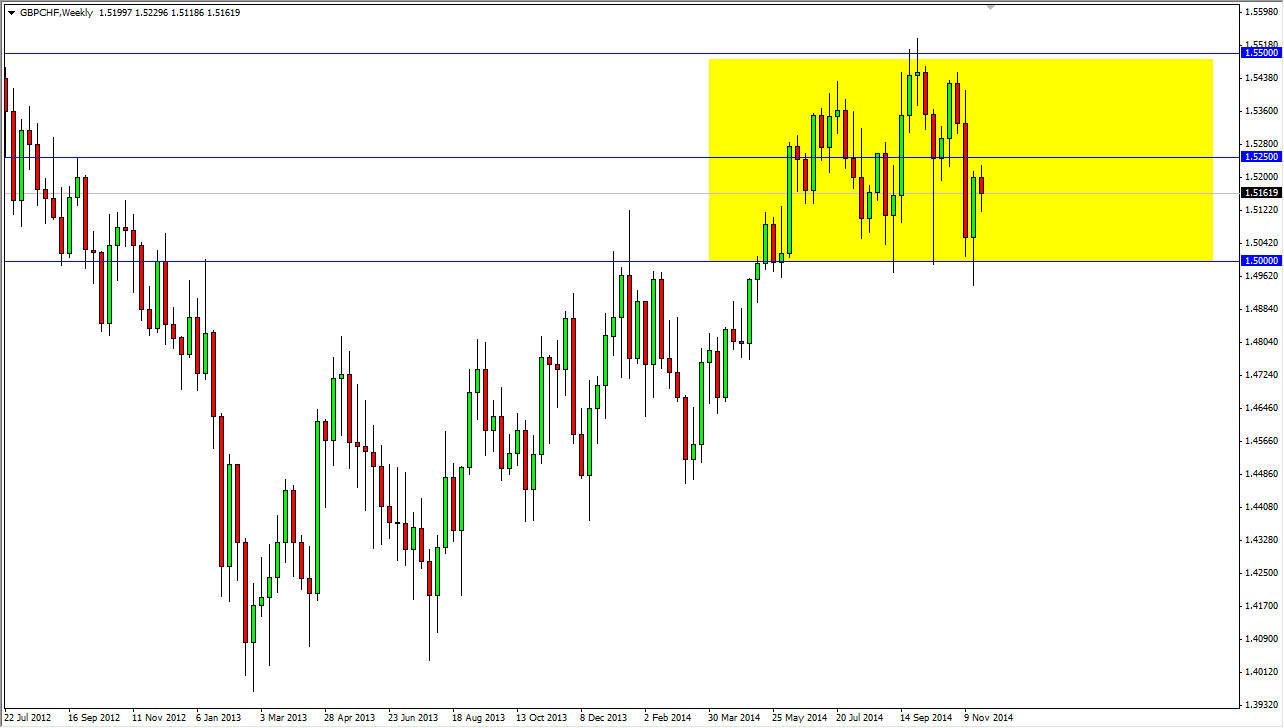

The GBP/CHF pair has been consolidating for some time now, and I believe that will be the theme going forward. After all, at the bottom of the range is the all-important 1.50 handle, and that of course will attract a lot of big figure traders. Because of this, I believe that the month will see several dips down to that area but will also attract a lot of buyers at that region. We have been bouncing around between the 1.50 level on the bottom and the 1.55 level on the top. I don’t see this changing during the month of December, especially considering how a lot of traders will simply be away from the markets towards the back half of the month.

I believe that ultimately range bound trading will take center stage, and as a result I will be buying this pair a time he drops to the 1.50 level. It is possible that the 1.5250 level continues offer resistance, as it is essentially “fair value” based upon the fact that it is halfway between the buyers and the sellers. Nonetheless, I believe that the uptrend will eventually prevail, and we will break out to the upside but I do not anticipate seeing that until we get into the month of January.

Europe will continue to punish Switzerland

The biggest problem that the Swiss have right now is that roughly 90% of their exports go into the European Union. As long as the European Union is financially struggling, Switzerland by default will have some issues. Because of this, we can anticipate that the United Kingdom will be favored over the European Union, and then by extension the Swiss economy.

With that, I believe that eventually we will get above the aforementioned 1.55 handle, and then head to the 1.60 level which I believe will be targeted some time later in January. Having said that though, I anticipate volatility to drop off drastically somewhere around 15 December. With that, I believe that looking at the 1.50 level as relative value is probably going to be the best way to go.