By: YesOption

New legislations in the U.S appears to have done more than enough in clamping down inversion deals, which have been rampant in years past. Pfizer Inc. (NYSE:PFE) had sought to acquire AstraZeneca plc. (ADR) (NYSE:AZN) earlier this year and is unlikely to place another bid in the wake of the new legislation.

Increased tightening of U.S. tax rules have greatly discouraged inversion deals. Therefore, it came as no surprise when AstraZeneca CEO, Pascal Soriot, admitted that new legislation will make it difficult for Pfizer to pursue AstraZeneca in the future. The new legislation already forced AbbVie Inc. (NYSE:ABBV) to abandon its agreement to purchase Shire PLC (ADR) (NASDAQ:SHPG).

AstraZeneca made its remarks after posting better than expected Q3 earnings, substantially upping its 2014 sales and profit forecasts for the second time in 2014. The company recently rebuffed a $70 billion bid from Pfizer in May, reiterating the estimate was slightly lower. These remarks continue to be justified because of better than expected quarterly earnings.

AstraZeneca revenues soared by 5% in the third quarter to a high of $6.5 billion, marking its third consecutive quarter sales increase. This year marks the first its revenues grew since 2011. If it continues this ongoing growth rate, Pfizer will ultimately be required to pay significantly if it wants to be successful in any merger agreement.

Pfizer sought to acquire AstraZeneca back in May, and shift its base to abroad in order to avoid incurring high taxes back at home. Under British law, Pfizer will be allowed to make another bid for AstraZeneca starting November 26.

AstraZeneca is scheduled to brief its investors of its future plans on the 18th of November, just eight days before Pfizer is allowed to offer a fresh bid.

Technical Analysis

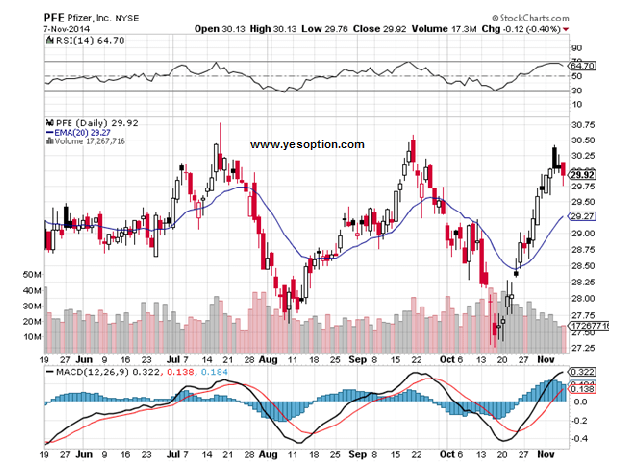

Pfizer topped out in the short-term, after finishing Friday under 0.40% at the end of Friday’s trading session. The stock is situated in a very narrow range of $0.37, with the stock currently trading above its 20-Day EMA of $29.27. However, the momentum indicator such as the RSI is drifting downwards. It would be therefore, safe to assume that the stock might move down in near-future.

Actionable Insight:

Sell Pfizer Inc. (NYSE:PFE) below $29.75 for target of $29.4, $29, with stop-loss of $30