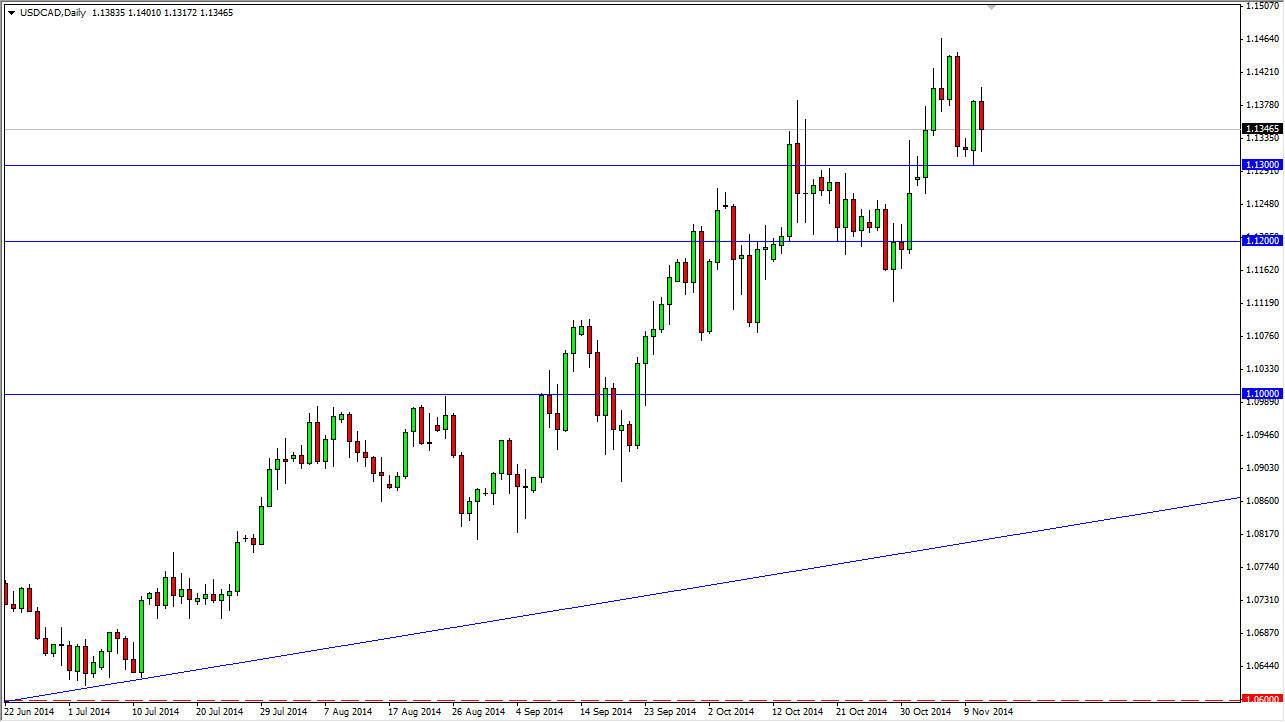

The USD/CAD pair fell during the bulk of the session on Tuesday, but the 1.13 level continues offer a little bit of support. I think that this market continues to go higher, and even if we drop below here, I would anticipate that the 1.12 level should offer support as well. Ultimately, this market should go higher, probably heading to the 1.15 handle. Because of this, I am very bullish of this market and I recognize that there isn’t much in the way of fundamentals that should bring this market lower anyway.

I believe that the US dollar will continue to be one of the most favored currencies around the world going forward, and the Canadian dollar of course will continue to struggle although it will do better than most other currencies in different regions of the planet. This is because the Canadian dollar is of course a North American currency, and by proxy it benefits from the US economy.

Oil markets aren’t helping

The oil markets are not helping the Canadian dollar, as they keep falling. I think that the oil markets are going to break down relatively significantly in the short-term, and therefore I think we continue to move much higher. I think that the 1.15 level will be targeted first, but keep in mind that this pair does tend to be very choppy. That’s because the two economies are very interconnected, and with that being the case, it’s very rare that we have an impulsive market going forward. We do see impulsive move some time to time, but they tend to be very sudden after quite a bit of grinding. So with that in mind, if you are going to start buying this pair you have to be willing to hang onto the trade for a while.

This market is in an uptrend for reason. After all, the United States is doing better than other economies around the world, and the Canadian economy is highly leveraged to the oil and gold markets. It is basically a commodity-based economy, and although the Americans help with their purchasing, the truth of the matter is global demand is very weak for most commodities going forward anyway. I am a buyer on dips.