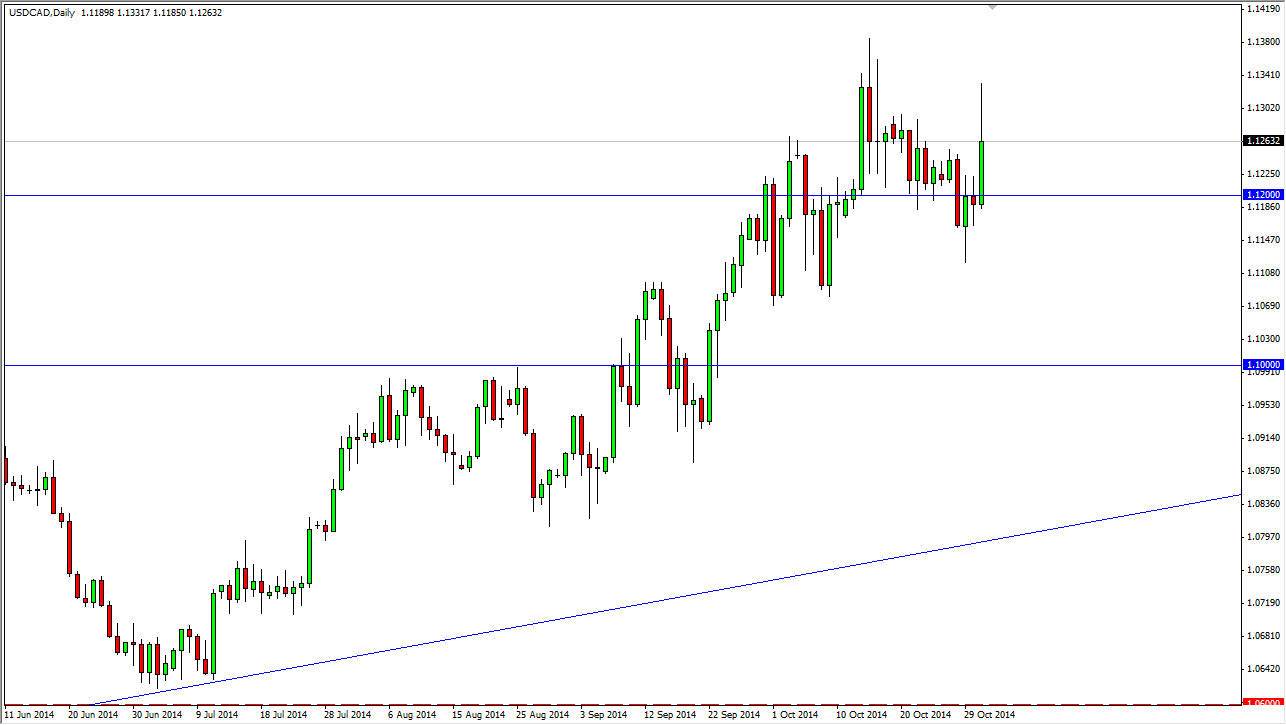

The USD/CAD pair broke higher during the course of the session on Friday, slicing through the 1.13 level during the day. However, we did bring in a bit of selling pressure later in the day, and as a result the market ended up forming a positive candle, but it does show signs of trouble above. With that being the case, although I am very bullish of this market, I recognize that it’s going to be a fight to get to the higher levels that I anticipate seeing later.

Ultimately, I do think that we get above the 1.14 handle, and continue to go much higher. In fact, I believe that we eventually hit the 1.12 level given enough time, but we do of course will not see that between now and the end of the year. I think that more realistically, we will probably see the 1.15 handle, as the oil markets asserting to find significant support in the range of $80 or so. Remember, the Canadian dollar is greatly influenced by oil prices.

Choppy conditions abound

I believe that choppy conditions will continue going higher, so therefore it is going to be a bit difficult to hang onto long positions for a lot of traders out there, but at the end of the day it’s probably only a matter of time before we break out. If you have a longer-term Outlook, it will be much easier to deal with the USD/CAD pair, which does tend to be very sluggish and choppy at times.

Looking forward, I think that every time this market pulls back, there will be buying opportunities in this marketplace. The US dollar should continue to be the strongest currency of the G 10, and as a result I have no interest whatsoever in selling this market. In fact, I believe I see significant support all the way down to the 1.10 handle, and possibly even below there. With that, this is a “buy only” market as far as I can see.