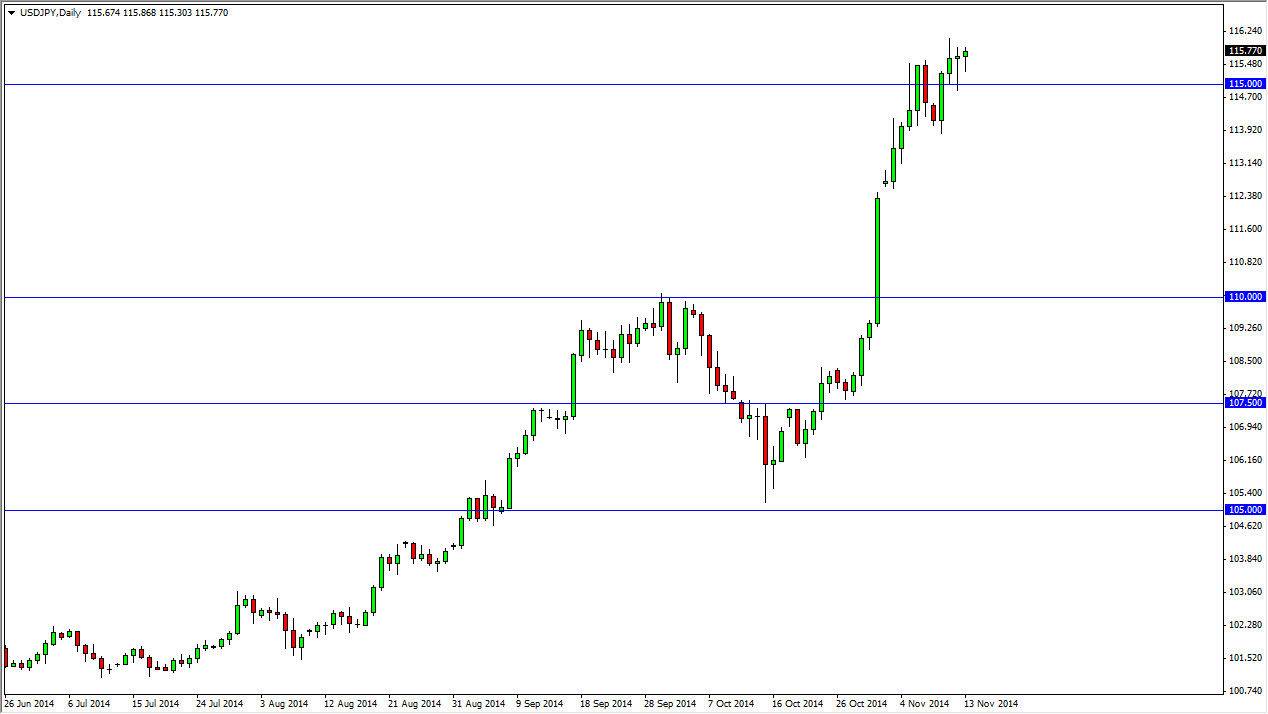

The USD/JPY pair found support at the 115 handle yet again, as the market continues to show bullish behavior. We believe that the US dollar will continue to be one of the favored currency by Forex traders around the world, and as a result there’s really no way to short this market, especially considering how poor the Japanese yen has been doing. Ultimately, we think that this market will probably go much higher given enough time, but between now and the 120 level will probably continue to offer buying opportunities every time it pulls back. After all, the US dollar continues to be one of the strongest performers that we follow.

The Federal Reserve has left the quantitative easing game, while the Bank of Japan is probably just begun yet another move into it. With that being the case, buying yields will continue to split the values of these currencies, and then send this market much higher.

112.50 could be the floor

The 112.50 level could be the floor in this market. Ultimately, this market should go much higher and I believe that this is the beginning of a longer-term “buy-and-hold” type of situation. After all, there’s no way to short the US dollar in general, and I believe that the Japanese yen is essentially dead money waiting to happen. With that, I believe that we will buy and buy again going forward. I think this market will ultimately end up being one of the situations that will make several careers, as there is such a strong trend. If you are patient enough, this is the type a market that will pay you time and time again going forward.

Even if we broke down below the 112.50 level, I believe that the 110 level below would also cause quite a bit of support. With that, I believe that this market won’t be able to be sold until we get way below that level, and I just don’t see that happening anytime soon. Ultimately, this is one of my favorite trades, buying.