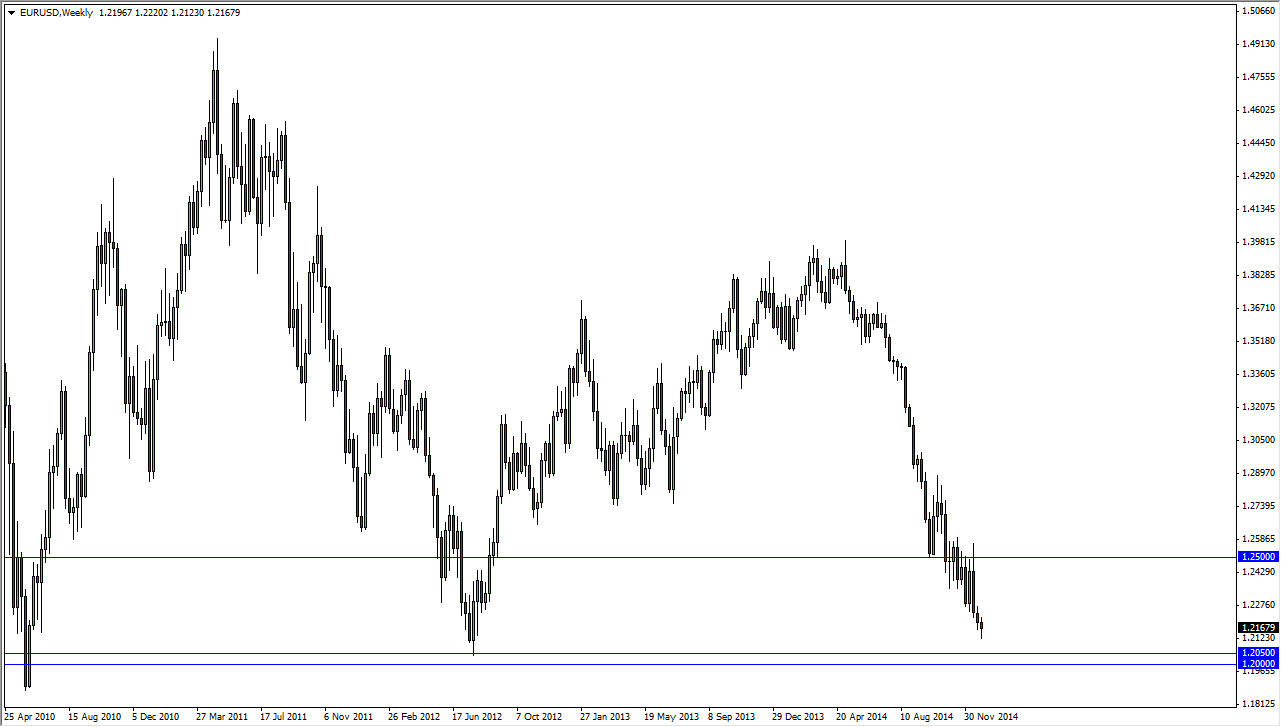

The EUR/USD pair has been in a massive decline for some time now, but when I look at this chart I recognize that we may be reaching the end of the downtrend, at least for a while. After all, the 1.20 level below is a massive support barrier that we have seen come into play a couple of different times over the last five years. With that being the case, and the fact that we have sold off so viciously, I believe that we are reaching the end of the downtrend, at least for the short-term.

With a short-term, I mean possibly several months. Yes, I recognize that the Euro has a lot of issues and could continue to have those issues for some time. Ultimately though, there comes a point in time where there is almost nobody left to continue selling. With that, it’s very likely that the bounce that has been needed for some time is coming.

Is the trend changing?

When I look at the downtrend, I recognize that there is a significant amount of bearish pressure, but at the same time the rate of descent has slowed drastically. I believe that we are at a very important juncture, simply because the pair has been sold off so viciously and so overdone in that time. Ultimately, if there’s any hint whatsoever at the possibility of the Federal Reserve loosening monetary policy again, this pair will skyrocket to the upside.

Because of this, I feel that the market will more than likely look for reasons assert going higher, because quite frankly even in this environment, the 1.20 level is a bit on the cheap side as far as the Euro is concerned. If the European Central Bank suddenly looks less likely to loosen its monetary policy, that’s reason enough for this pair to go higher as well. In other words, I think now the upside risk is a lot higher than the downside risk. We have simply gone too far to the downside to justify selling at this point in time. I think that we will see a little bit of weakness in the beginning of the month, but eventually sometime during the month of January, we will see the buyers return.