Gold prices ended Thursday's session up 0.75%, or $8.88, to settle at $1198.03 an ounce. The XAU/USD pair tested the $1212 level but encountered resistance and dropped back below $1203 once again. The Fed's pledge to "be patient in beginning to normalize the stance of monetary policy" has resulted in a positive sentiment but it also sent the major equity markets higher, reducing the need for a disaster insurance. On Wednesday, Federal Reserve Chair Janet Yellen said "The statement that the committee can be patient should be interpreted that it is unlikely to begin the normalization process for at least the next couple of meetings".

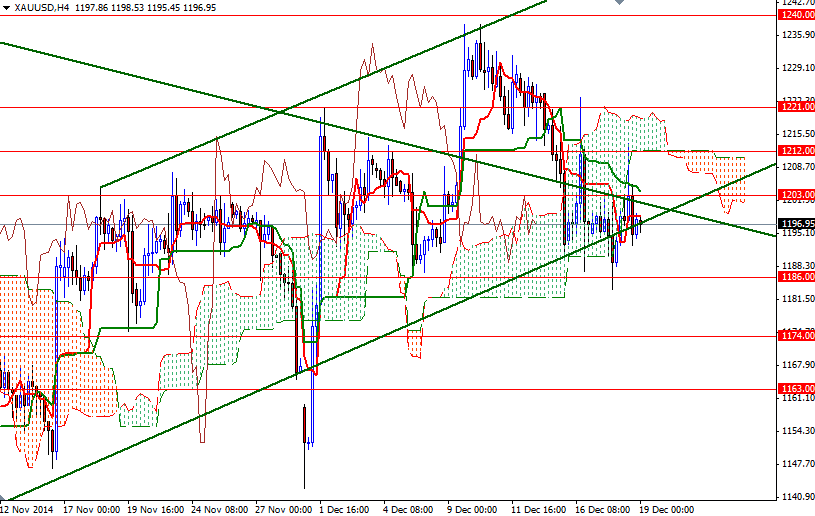

Trading within the boundaries of the Ichimoku cloud (daily chart) suggests there is an intense battle going on between the bears and bulls. The 1212 level where the top of the daily cloud and the Tenkan-sen line (nine-period moving average, red line) converge seems to be the first important hurdle. If the market climbs and holds above this level, we might see another assault on the 1221 resistance level. Only a sustained break above this former support/resistance could change the short term scenario.

The support zone at 1186/3 remain as a key level to the downside. If we fall through, it is likely that the XAU/USD pair will revisit the 1174 level. A drop below 1174 would place control back into the paws of the bears as we head towards the 1163 support level. Since today's economic calendar is light, the USD/JPY pair and stock markets will be on my radar.