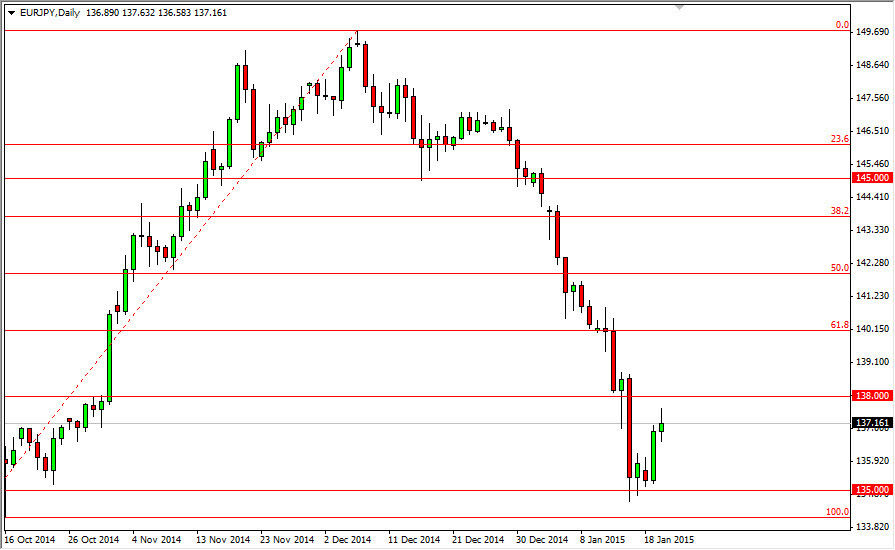

The EUR/JPY pair initially tried to rally during the course of the session on Tuesday, but gave back most of the gains as we approached the 138 handle. The 138 handle was previously supportive, so of course it makes sense that it would end up being resistive. I believe that the pullback that shows itself being a shooting star of course is a nice selling opportunity and a market that is without a doubt negative in its attitude. Because of this, it is a classic technical analysis signal if we break the bottom of the shooting star to start selling and aim for the 135 handle, which has shown itself to be supportive.

The Euro continues to struggle overall, and as a result we believe that this market will be very soft. Because of this, we have no interest in buying this market, but we do recognize that of this market breaks above the 138 handle, we could then head to the 140 level. That area has another cluster added that could again offer resistance. After all, it is a large, round, psychologically significant number.

A battle two weak currencies

Both of these currencies are extraordinarily soft, with the Euro selling off against almost everything, and the Yen definitely doing so. That being said, one of the best indicators that we have for this marketplace is the EUR/USD pair, and the EUR/GBP pair. As both look like they are getting ready to fall, I believe that this market should continue to grind much lower. Even though the Japanese yen is so reviled at the moment, it appears that the market should continue to favor the Yen in this particular instance.

I don’t know if we can break down below the 135 level, but a break down below the bottom of the shooting star for me represents at least a short-term selling opportunity. It should be good for 100 pips or so, so certainly worth the trouble as it is with the overall trend also. The 135 level below though is massively supportive.