EUR/USD Signal Update

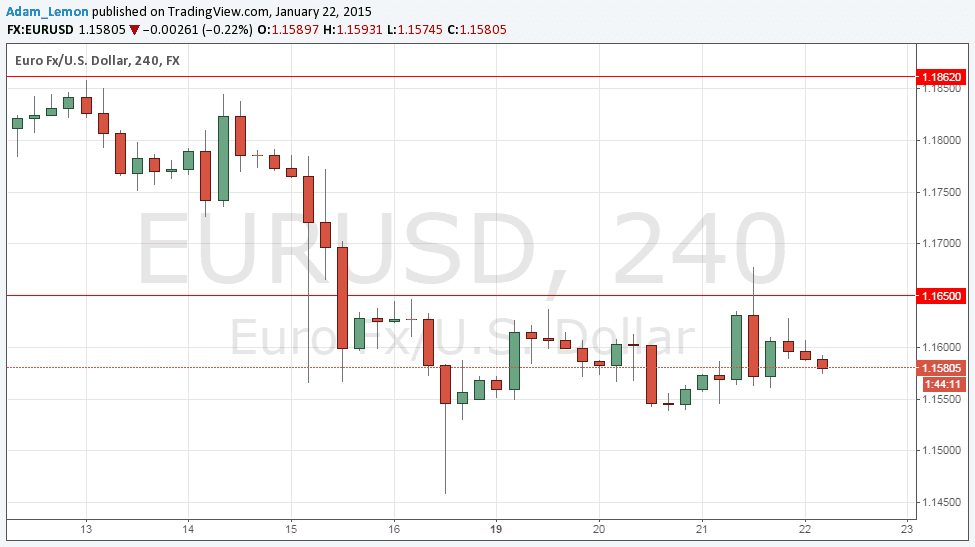

Yesterday's signals were in play as the price did reach 1.1650 during the London session, before quickly falling off it as expected. However, it was right at the end of the London session, so it was too late for the bearish price action to trigger any short trades.

Today’s EUR/USD Signals

No signal is given today. Trades with existing profitable positions that were entered some distance away from the current price may wish to collect most profit and leave small sizes on the table in the hope that the ECB announcement will move the position dramatically in the desired direction. There is probably more potential for surprise on the upside (long) than downside (short).

EUR/USD Analysis

I wrote yesterday that it was unlikely that the expected resistance level at 1.1650 would be reached during the London session. It was reached in fact, but almost certainly only because there was a leak of the alleged intentions of the ECB. If the leak turns out to be a true reflection of the ECB's intentions and was not authorised at the highest level, it reflects very poorly on the operational reliability of the ECB. Central banks have to be able to keep their own secrets.

It was not a surprise that the price was unable to remain above the 1.1650 level, before falling quickly. This would have given a short trade but it ran out of time and momentum.

Barring any other surprise announcements, this pair should be aimless and fairly still until the New York session when the ECB will begin a press conference, with the market expecting a detailed announcement of the beginning of a program of quantitative easing. This will almost certainly cause high volatility and it would be wise not to enter any trades until things settle down, so I cannot give any signals today.

If the QE program is non-existent or very weak, the pair might shoot up dramatically by hundreds of pips. If the program is as leaked or stronger, the pair will probably resume its downwards trend.

There are no high-impact data releases scheduled today concerning the USD, but it will be a huge news day for the EUR. At 12:45pm London time the ECB will announce the Minimum Bid Rate. At 1:30pm the ECB will open a press conference in which they are expected to announce the launch of a detailed program of Quantitative Easing. This should have a great impact upon the EUR.