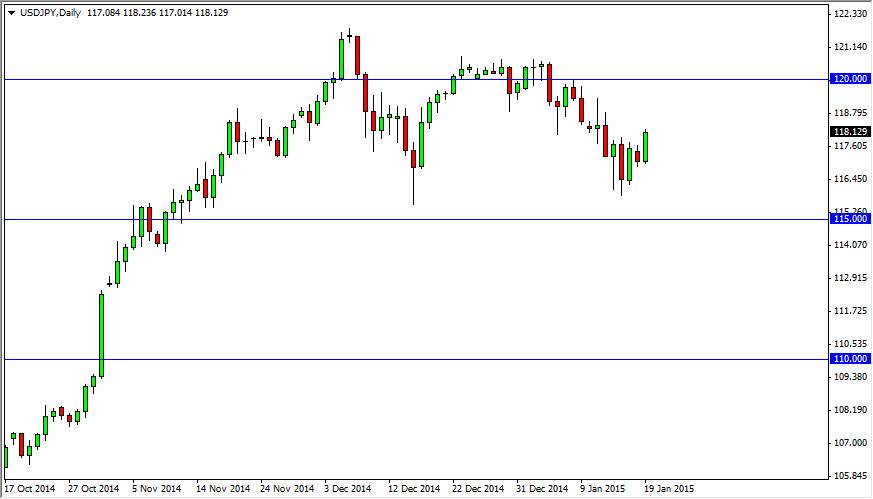

The USD/JPY pair broke higher during the course of the session on Monday, clearing the 118 handle finally. Because of this, I feel that the market is going to head towards the 120 level, which of course is resistance above. It does not mean that the market is going to have an easy time of it just simply that we are going to continue to consolidate as we have before. With that being the case, I believe that buying short-term pullbacks might be the way going forward as the US dollar is without a doubt stronger than the Japanese yen overall.

I believe that the market will eventually break out to the upside, but we could have a bit of a fight on our hands as the market tries to build up enough positive momentum. Ultimately though, I do believe that we probably head to the 125 level over the next couple of months as the US dollar is the strongest currency in the Forex markets right now, just as the Japanese yen is one of the weakest.

Central banks

Central banks continue to flaunt monetary policies, with the Japanese being one of the easiest monetary policies out there. The US on the other hand has to away from quantitative easing, so it makes perfect sense of this market should continue to go higher. That being said though, and does it mean that it’s not going to be an easy ride higher, and I believe that there will be plenty of volatility. It appears that we are simply taking a bit of a breather after a massive move higher, that we had seen occur over the majority of the year.

I have no scenario in which a willing to sell this market as I believe the 115 level will continue to be the floor in the market, and even if we broke below there I think that we would have plenty of support all the way down to the 110 level. Ultimately, this is a “buy on the dips” type of marketplace.