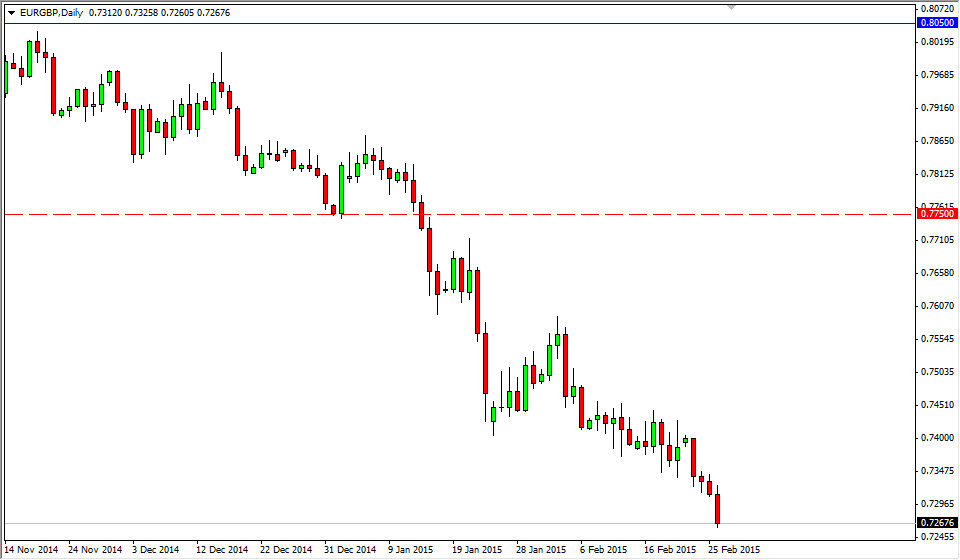

The EUR/GBP pair initially tried to rally on Thursday, but fell significantly from there. By doing so, the market ended up forming a very negative candle, and as a result looks like it’s ready to continue much lower. With that, I feel that the market should then head to the 0.71 handle, and possibly the 0.70 handle given enough time. I have no interest in buying this market, because I see so much in the way of resistance above. The 0.74 level is particularly resistive, and as a result any type of resistant candle in that general vicinity should be reason enough to start selling again. I don’t really have a scenario in which a willing to buy this market mainly because of the problems in the Euro right now, and the relative strength of the British pound when compared to the Euro in general.

Simply following the trend

I am simply following the trend in this pair, as the Euro continues to struggle overall. Because of this, I think that the Euro continues to be a currency that will struggle due to the deflationary pressures in the European Union, and quite frankly simply because there is a significant amount of pressure on the European Central Bank to increase liquidity still. There are problems in Greece that simply cannot go away, and of course a plethora of problems in almost every European country. With that, it’s difficult to start buying the Euro as confidence is certainly low.

It isn’t that the British pound is a currency that looks massively strong at this point in time, but it does have the benefit of not be in the Euro. On top of that, there has to be a significant amount of money coming out of the European Union and into the United Kingdom in the form of investing in order to preserve wealth by large firms and wealthy individuals in the European Union. Because of this, the market should continue to the downside for the foreseeable future.