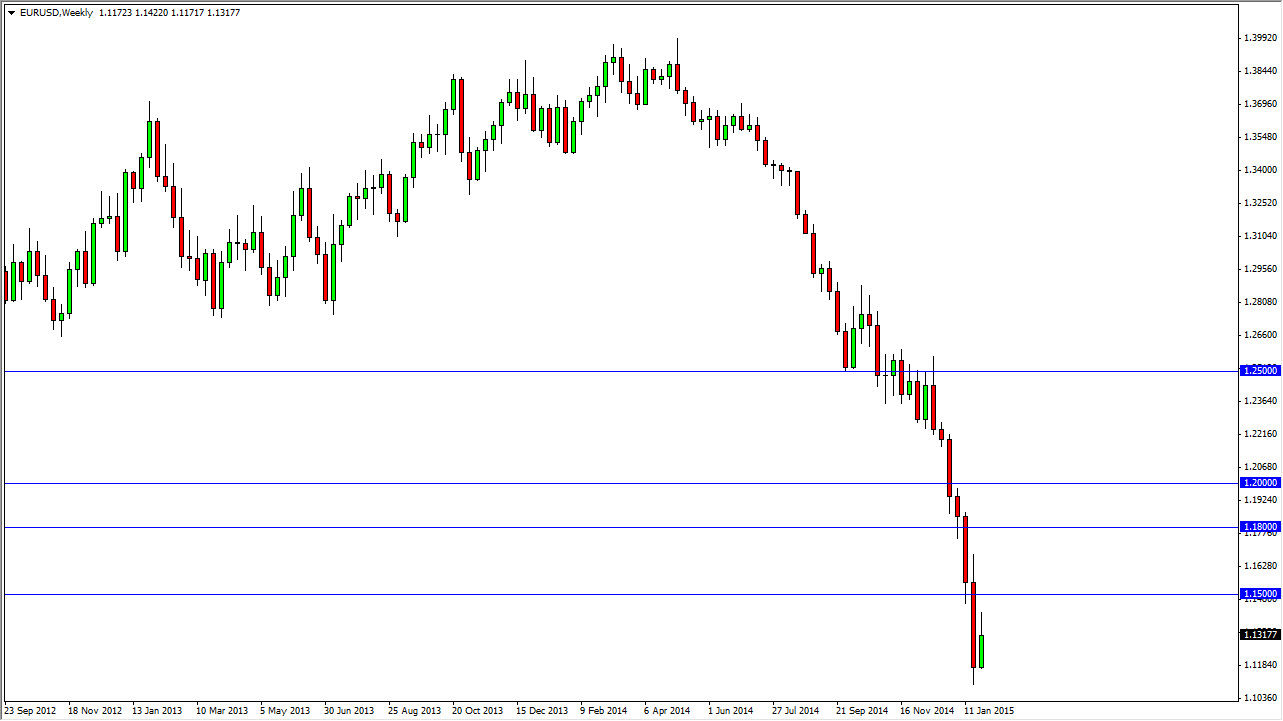

The EUR/USD pair broke higher towards the end of January, but still remained below the 1.15 level. Quite frankly, market has sold off and is a bit oversold but at the end of the day there are too many factors working against the Euro to think that this pair will rally for any significant length of time. Quite frankly, I believe that every time that this market rallies it represent value in the US dollar.

As treasury yields fall, it suggests that more and more money is going into the bond market. That’s case, it drives down yields but also is indicative of people pouring money into the United States. In order to do so, they have to buy US dollars which of course drives of the demand for the greenback. The most obvious place to see this is against the Euro, and with that we are more than likely going to see continued selling. Any rally at this point in time would be a bit of an anomaly, and I’m not impressed until we get above the 1.20 handle.

The Euro is broken

I believe that the Euro is broken, and with a good reason or two behind it. The European Central Bank will continue to expand monetary policy, course is going to be very negative. That being the case, I don’t see any way out for the Euro, and with so many problems in places like Greece and now potentially Spain, the truth is that the Euro is going to continue to be treated with suspicion that suspicion will carry over into the currency markets where people will sell the Euro.

The fact that the US dollar is the favored currency around the world isn’t lost on me either. Because of this, I see no way that this pair rises for any length of time as there are is a severe lack of trust. I think that we will go down to the 1.10 level, and sometime during the month of February we will see this pair break down below that handle as well.