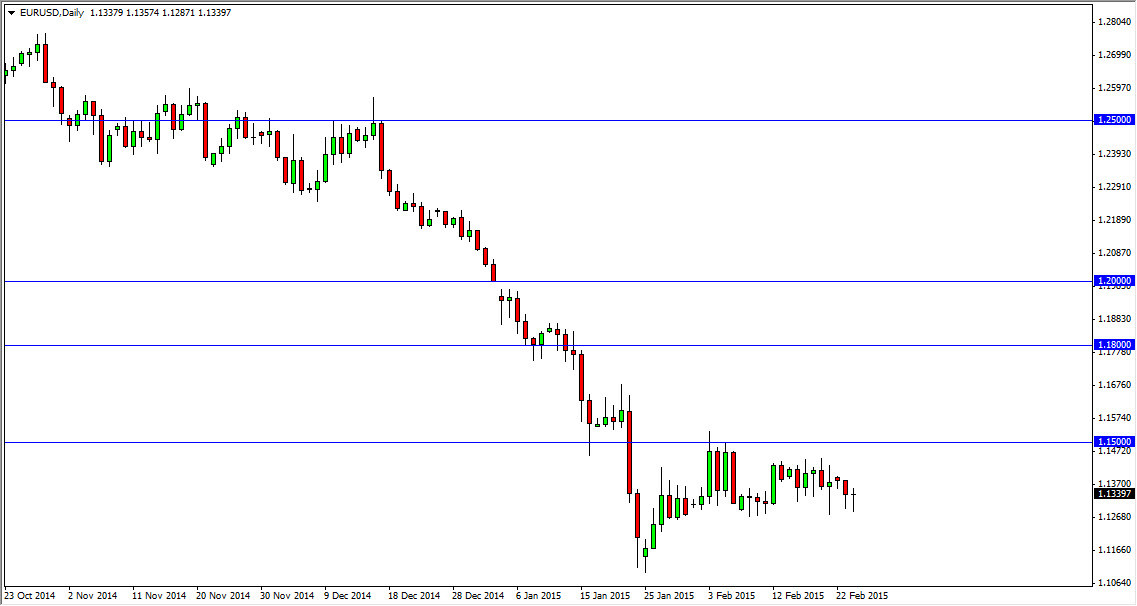

The EUR/USD pair initially fell during the session on Tuesday, but found support near the 1.13 level yet again to bounce and form a nice-looking but small hammer. Ultimately, I feel that this market is simply going to continue consolidating, meaning that the 1.15 level is the ceiling. I think that going back and forth during the next several sessions is probably going to be what you can expect, so if you want to buy the pair you can on a break above the top of the hammer, but it is a short-term buying opportunity at best.

On the other hand, if we rally from here I would anticipate that the area above the 1.14 level should offer selling opportunities. With that being the case, I feel that it’s easy to sell this market because of the longer-term downtrend being in place. Remember, the European Union has a plethora of problems, including potential deflation.

European Central Bank

I believe that the ECB is stuck and is going to have to continue adding liquidity to the marketplace. With that being the case, I believe that the Euro is in fact going to go lower. However, we have fallen significantly so it’s not a big surprise that we would have to consolidate in this general vicinity. I have a longer-term target of 1.10, and then possibly even parity for we can get below there. The next couple of months will be vital in this particular pair, but I think that the market will certainly catch its breath in the meantime and that means that we should have short-term trading opportunities at best.

Because of this, I am not willing to hang onto any trade for any real length of time, and I imagine that the short-term traders will continue to be the ones to push this market for most. Even if we did break above the aforementioned 1.15 ceiling, there is a massive amount of resistance all the way to the 1.1650 level. Because of that, I believe that we are essentially stuck at the moment.