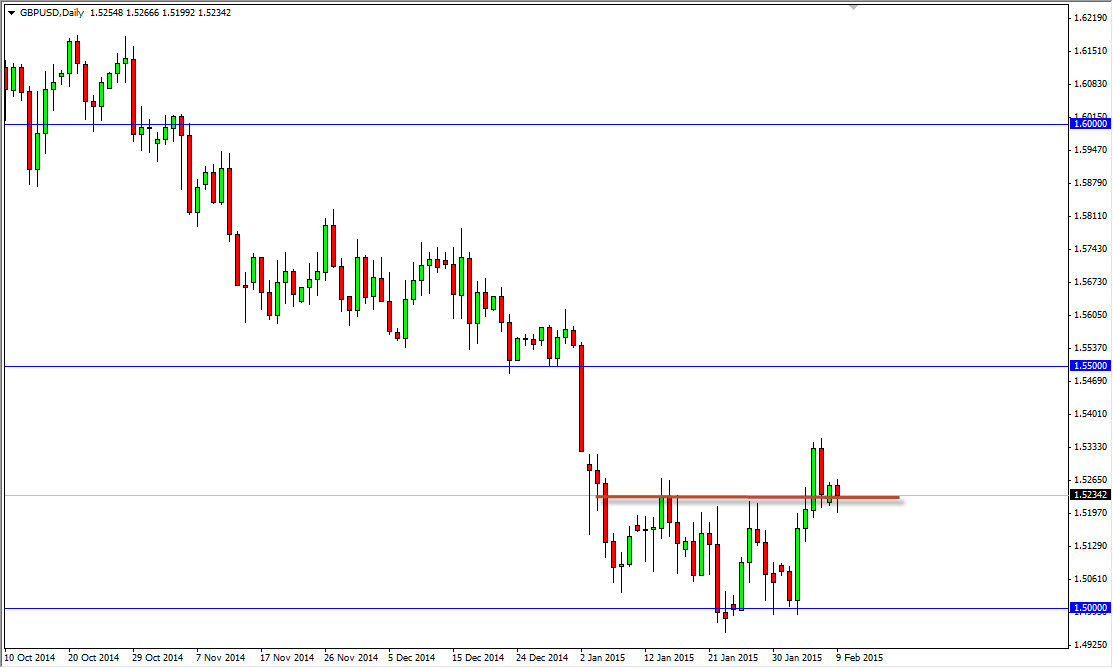

The GBP/USD pair fell during the course of the session on Monday, but as you can see found enough support near the 1.52 level to turn things back around and form a hammer. The hammer of course is a very bullish sign and the fact that this area was previously resistance has caught my attention as well. This is a basic tenets of technical analysis, “what was once resistance now become support”, and of course the opposite is true. The fact that we formed a hammer suggests to me that the market will break out to the upside here in a bit, probably aiming for the 1.53 level first, and then eventually the 1.55 handle.

Even though I feel the market is going to go up to the 1.55 level, I do not feel that we are going to break out above it. With that being the case, I think that this is more or less a short-term set up and there’s no way that I’m going to hang onto this trade because of the resistance above, and the fact that it probably extends all the way to the 1.58 handle.

1.50 continues to be the most important number

I believe that the 1.50 level below continues to be the most important number in this currency pair, because it is such a large number overall. On top of that, there is a massive amount of support below that area, and extending all the way down to the 1.48 handle. Because of that, I don’t really have any interest in selling this pair at this point in time because even though that area is massively supportive, I see a lot of noise between here and there as well. Because of previous volatility, I’m just not interested in risking money at this point in time.

This pair will continue to be choppy in this general vicinity after all, especially considering that the British pound is doing fairly well, but of course we are measuring it against the greenback in this particular situation which of course has done extraordinarily well. This is a pair that will probably “hold its own” in relation to other currencies against the US dollar.