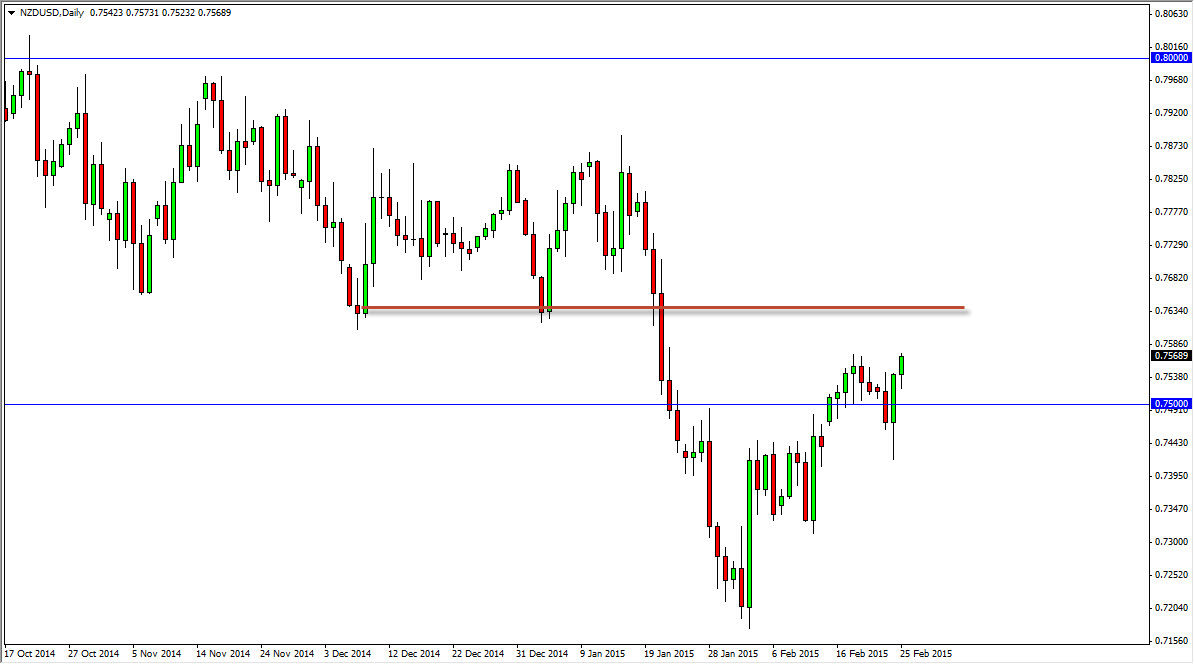

The NZD/USD pair initially fell during the session on Wednesday, but as you can see turned things back around to form a hammer. That being the case, the market looks as if it is ready to continue going higher, but I suspect that there is a significant amount resistance at the 0.7650 level. That was an area of significant support previously, so would not surprise me at all if we see selling pressure in that area. I also see significant support near the 0.74 handle, so at this point in time it’s difficult to imagine this market moving too quickly. I think in the short-term we will go higher, but I am actually more impressed by selling this market if we get a resistant candle just above.

Keep in mind that the New Zealand dollar is highly correlated to the commodity markets, so this of course will move with the overall attitude of commodities in general. It’s not necessarily tied to one particular market, it’s just more or less the general attitude.

Continued volatility going forward

Regardless of what happens longer-term, I think that the pair will be rather volatile over the next several sessions. With that being the case, a lot of traders will probably avoid this market but I think that there are plenty of trading opportunities to be had but you cannot hang onto the trade. This is a difficult market at times, but I think ultimately we will have a nice longer-term move to the downside.

Keep in mind that the Royal Bank of New Zealand has suggested that they need to see this market go down to the 0.68 handle, and has shorting the Kiwi dollar recently. Both of those actions will of course have an influence on this market longer-term. I simply think that we are getting a bit of a relief rally in both the Kiwi dollar and the commodity markets, but at the end of the day not much has changed and therefore the trend should continue.