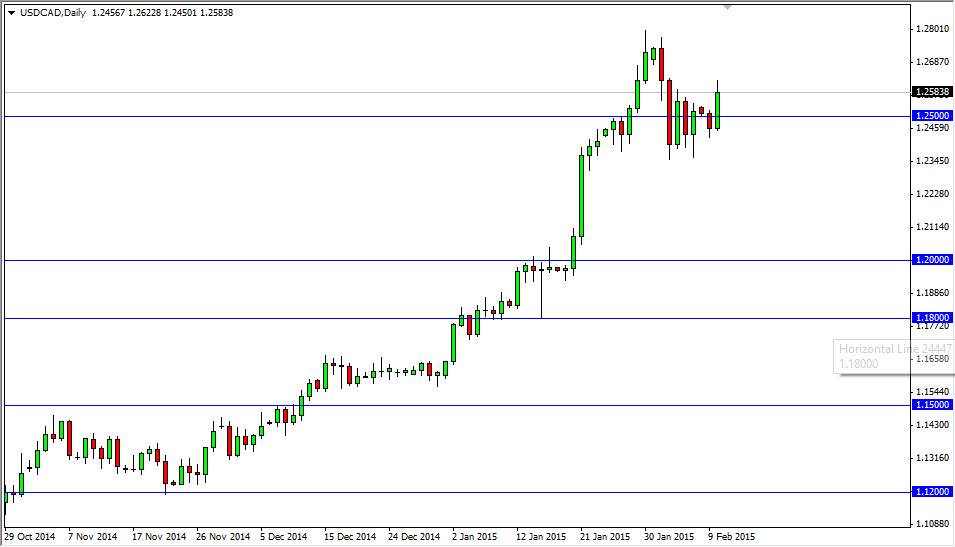

The USD/CAD pair broke higher during the course of the session on Tuesday, clearing the 1.25 handle yet again. With this, the market looks as if it’s ready to continue going higher, probably heading to the 1.28 level next as it was the most recent resistance that the market found. On top of that, the US dollar is still one of the strongest currencies around the world right now, and the Canadian dollar of course has the misfortune of being correlated to the price of crude oil. Crude oil markets certainly do not look like the ready to go higher for any real length of time, so I believe that there will continue to be significant pressure on the Canadian dollar. On top of that, do not forget that the Bank of Canada recently cut interest rates which of course is very bearish for a currency as well.

Massive resistance above

I cannot stress how important the 1.30 level is above. That is where the market stopped after the financial crisis, and as a result I believe that it is going to take quite a bit of effort to get above that level. Once we do, the Canadian dollar is toast. However, I think that we will more than likely have several attempts to break above that level anyway, so I’m looking to buy short-term pullbacks at this point in time. It’s not that I don’t think that we won’t break above the 1.30 level eventually, it’s just that it’s going to take some serious herculean effort.

Pullbacks at this point in time continue to be buying opportunities, even if we break down below the 1.2350 level which of course would be very bearish. Ultimately, I think that there’s so much support at the 1.20 level that it is essentially the “floor” in this market. With that, I am bullish and I do continue to buy for short-term moves but I recognize once we get above that 1.30 level, that is a longer-term buy-and-hold signal.