USD/JPY Signal Update

Yesterday’s signals expired without being triggered as although the price did reach 119.20 and bounced down there, at the first touch there was hourly close above that level, so the short signal was invalidated.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

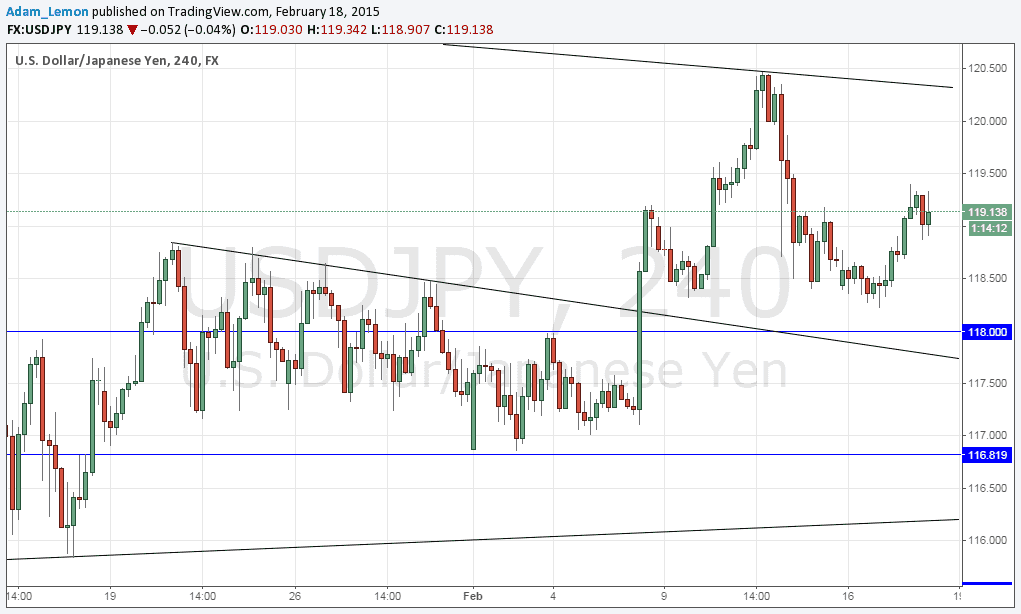

Go short following some bearish price action on the H1 time frame immediately upon the first test of the long-term bearish trend line currently sitting at around 120.30.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following some bullish price action on the H1 time frame immediately upon the first retest of the broken trend line which is currently sitting at about 117.75 and/or the level at 118.00 itself.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The price moved up after coming fairly close to support at 118.00 and has since not managed to break above anticipated resistance at 119.20. However that latter level has been messed up too much to remain useful, and I now see no clear-cut resistant levels before the long-term bearish trend line above 120.

Below the confluence of a broken bearish trend line and a supportive whole number at 118.00 looks to remain a good bet to be a trigger for another upwards move if price returns there soon.

There are no more events scheduled for the JPY today. Regarding the USD, at 1:30pm London time there will be a release of Building Permits and PPI data. After the close at 7pm London time, there will be a release of FOMC Meeting Minutes which should be the most important news event of the day.