The USD/SGD pair fell during the course of the session on Thursday, taking back all of the gains from Wednesday. The Singapore dollar is one of my favorite currencies to trade, simply because it is a good way to play Asian growth, or lack of it as it were. Singapore is a major financial center in the Asian region, and of course finances a lot of the massive work that gets done around the area. That is why the Singapore dollar represents Asian growth in general.

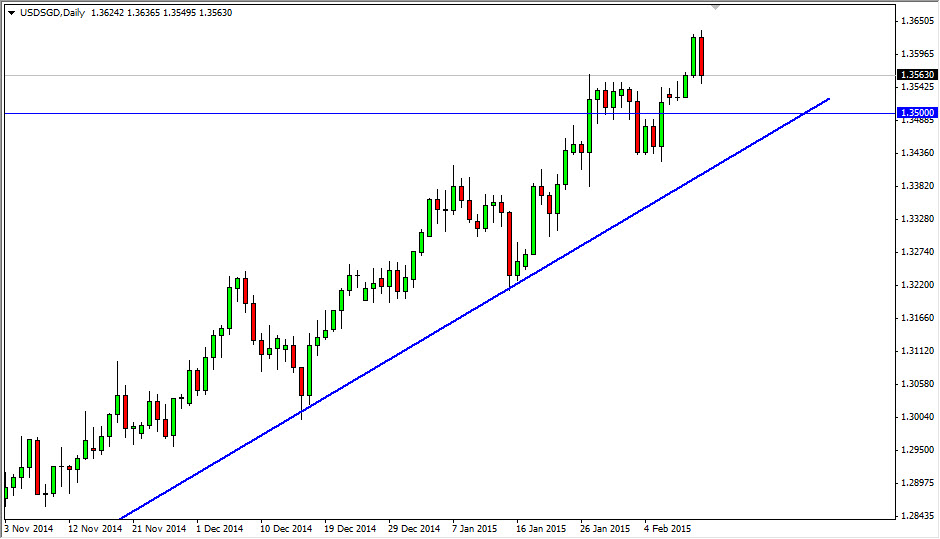

Looking at this chart, you can see that there has been a nice trend line that the market has followed for some time, and as a result I believe that this market will continue the very steady uptrend that we have seen for some time. I think that pullbacks represent buying opportunities, as there has been so much support previously. I also see the 1.35 level as been supportive, and we are starting to test that region right now for buying opportunities.

Simply following the trend

I think that the best way to trade this particular pair is to simply follow the overall trend. Don’t expect massive surges higher, because the market tends to be rather calm. That’s one of the great things about this pair, the volatility generally is an out-of-control. In fact, I often recommend that new trader’s use this is one of the currency pairs of they get involved with. After all, it’s easy to hang onto the move if it’s steady, and not erratic. Ultimately though, I think that this is a pair that has a lot of upside pressure, and serious potential to continue for a buy-and-hold type of situation.

I think that there is support all the way down to the trend line, even if we get down below the 1.35 handle. Nonetheless, I think we are getting ready to make a move to the 1.40 level if you are patient enough to hang onto the trade. Remember, this one tends to move kind of slowly and methodically.