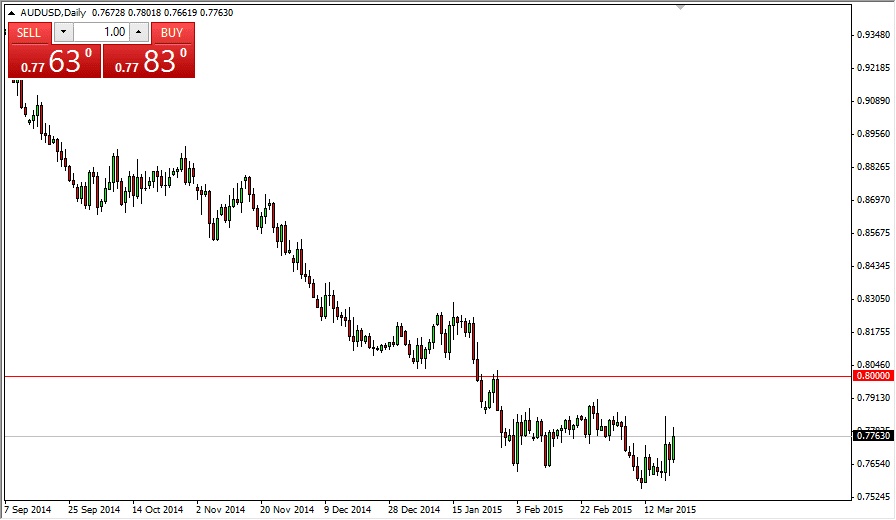

The AUD/USD pair broke hired during the session on Friday, as the US dollar weakened a little bit. However, the market looks as if there is plenty resistance above, and as a result I believe that there will be selling opportunities sooner or later. A resistive candle above would be nice selling opportunities or as I can tell, and at this point in time I don’t necessarily want to be involved with the Australian dollar anyway. The 0.80 level above offers resistance, and therefore I feel that the market will find that as a bit of a “ceiling.”

If we can break above there, that of course would be a very bullish sign but right now I don’t see the opportunity to do so. Quite frankly, even though the gold market looks like it’s going to rise a little bit, I don’t believe it’s going to be enough to push the Aussie higher. Also, you have to keep in mind that the US dollar is without a doubt the strongest guys in the Forex market right now, so it makes sense not to step in front of that trend.

Selling rallies

I believe the going forward is going to be a simple matter of selling rallies that show signs of resistance above. I’m looking for short-term setups though, because I believe that the daily chart will continue to be somewhat clogged. With that, I think that eventually we had down to the 0.75 level, but it is going to be choppy between here and there. With that, I think the best types of trades will be along the lines of intraday moves. I think that expecting anything more than a 75 PIP move in the short term is probably asking a bit much. So having said that, I believe that something inside again will be the way to go, but look to the hourly and perhaps the four hour charts for setups. If we can get below the 0.75 level, I believe this market that has down to the 0.70 level given enough time.