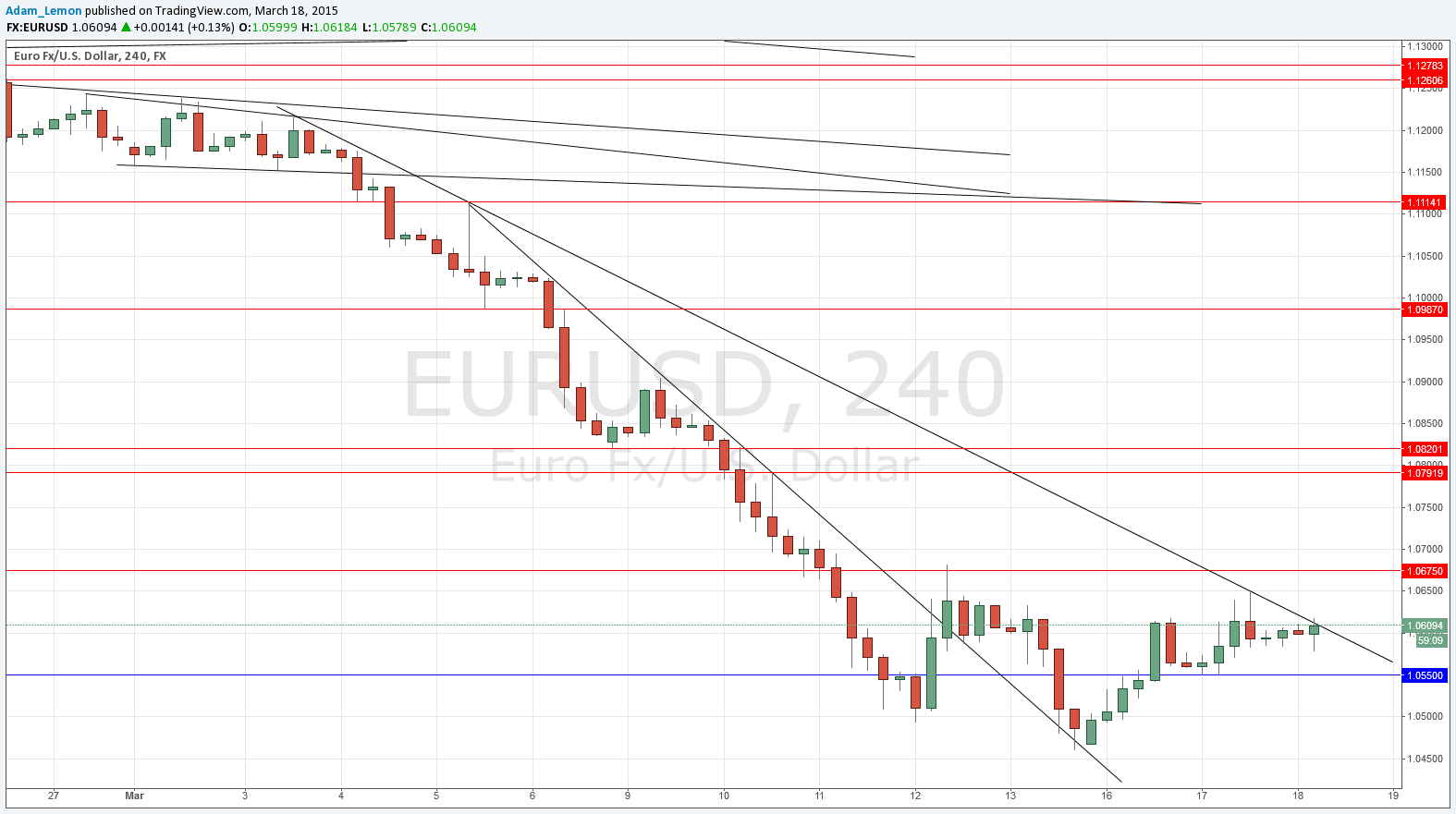

EUR/USD Signal Update

Yesterday’s signal expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered before 5pm London time and risk should be taken off any trade by 5:30pm.

Long Trade 1

• Go long following a bullish price action reversal on the H1 time frame immediately upon the first test of 1.0550.

• Place the stop loss 1 pip below the local swing low.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

• Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of 1.0675.

• Place the stop loss 1 pip above the local swing high.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

We have seen some continuing bullishness in the Euro, which has been due a pull back after its sharp fall. The bullishness has been underlined by resistance at 1.0550 becoming flipped to support. As I write, we are in danger of breaking up past another bearish trend line. However, moves ahead of the FOMC this evening are likely to be limited, and the future price movement is going to be heavily hinged to the fate of the USD.

There no high-impact events scheduled today concerning the EUR. At 6pm London time the U.S. Federal Reserve will be releasing the latest Federal Funds Rate and FOMC Statement and Projections. This will be very likely to have a heavy impact upon the USD.