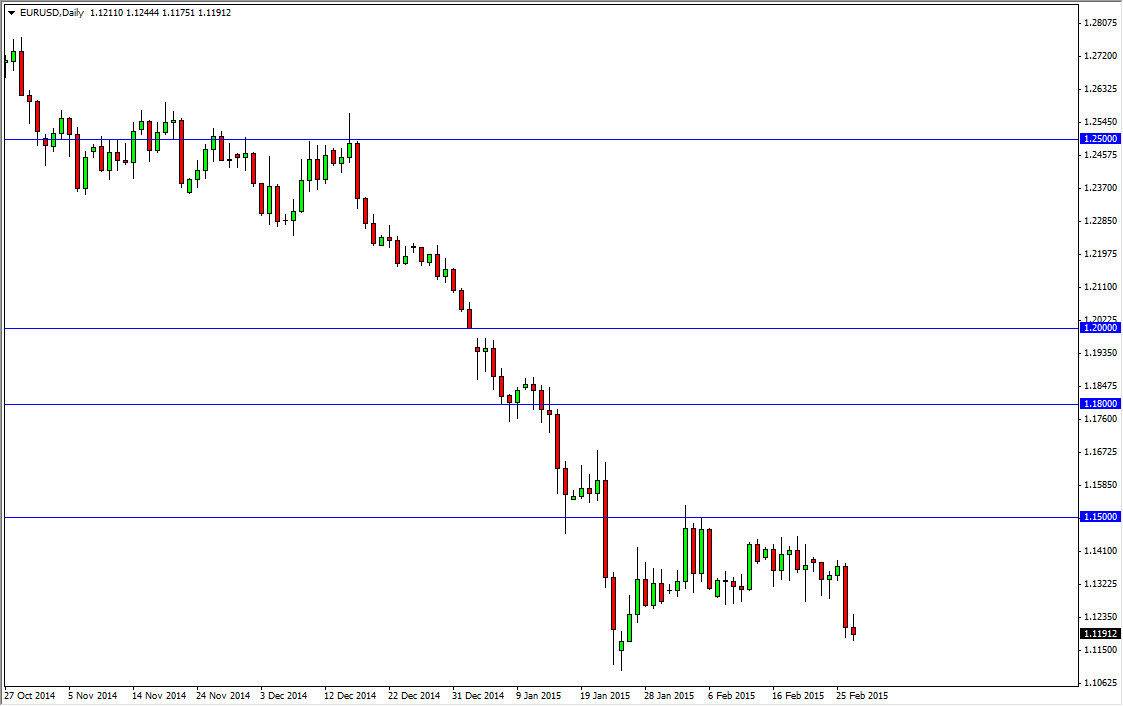

The EUR/USD pair initially broke higher during the course of the session on Friday, but found enough resistance to turn things back around and form a shooting star. That being the case, the market looks as if it is ready to continue going lower, and a break below the bottom of the range for the Friday session is reason enough to start selling. After all, you have to think about it in the terms of buyers not been able to hang onto the small amount of gains, which to show significant resistance.

If we break down below the bottom of the hammer, I think that this market then goes to the 1.10 level. That area will be massively supportive, but if we can get below there things get really ugly for the Euro, and we could be talking about going as low as the parity level - something I never thought I would say.

European Central Bank liquidity

The European Central Bank should continue to keep the markets fairly liquid, keeping loose monetary policy and therefore driving down the value of the Euro. There will be less demand for European bonds, and as a result less demand for the currency itself. Ultimately, I feel that every time this market rallies, it will be a nice selling opportunity as it will represent value in the US dollar, the favored currency around the world right now with perhaps the exception of the Swiss franc.

I think that the parity level is probably about as low as this pair can go though. It would be very difficult to imagine breaking below that area, but then again very surprising that we went this low. After all, the Euro seems to have “nine lives”, and never really sells off for any length of time.

I believe that the 1.15 level above is massively resistive, and that the resistance extends all the way to the 1.1650 handle. Because of this, I think that the market will continue to go lower as the buyers simply will not be able to overcome that region.