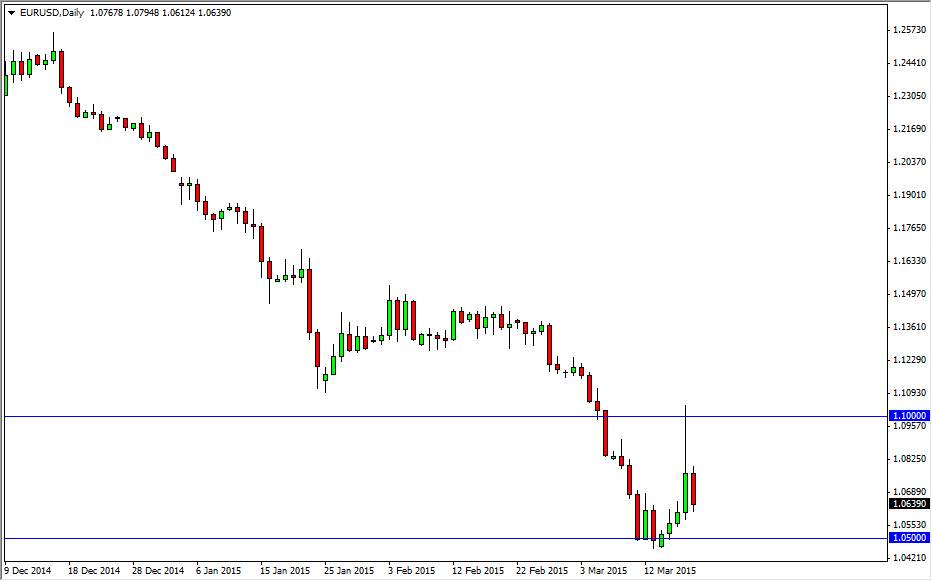

The EUR/USD pair broke down during the session on Thursday, completely wiping out most of the gains that the market had picked up on Wednesday. Remember, a lot of the reaction was based upon a knee-jerk reaction to the Federal Reserve and its statement, so having said that I believe that the market will continue the downtrend based upon the fact that we have seen such a turnaround. With this, the market looks as if it’s ready to get down to the 1.05 level again, which of course was massively supportive. Because of this, the market looks as if it will eventually target that area over the next couple of sessions.

Ultimately though, I believe that the market will break down below there and perhaps head to the parity level. Any rally at this point time should be a nice selling opportunity, although more than likely you will find that selling opportunity on the short-term charts, as there will be a lot of volatility between here and that area.

Continued downtrend

I believe that the downtrend will continue, because quite frankly there’s far too many problems in the European Union. The fear of deflation will continue to plague the Euro as the European Support Bank will have to continue extreme liquidity measures in order to fight that particular problem off. Ultimately, the US dollar is the favored currency in the Forex market, and as a result every time this market rallies it will be value in the US dollar, and more than likely the market will continue to use that as an excuse to sell.

It is not until we break above the 1.15 level that I would be even convinced that the market is one that safe to start buying. With that, I am a seller and a seller only, and recognize that the market has certainly made up its mind as to which direction we should continue to go. After all, after that massive move higher, we still find the bearishness to sell off.