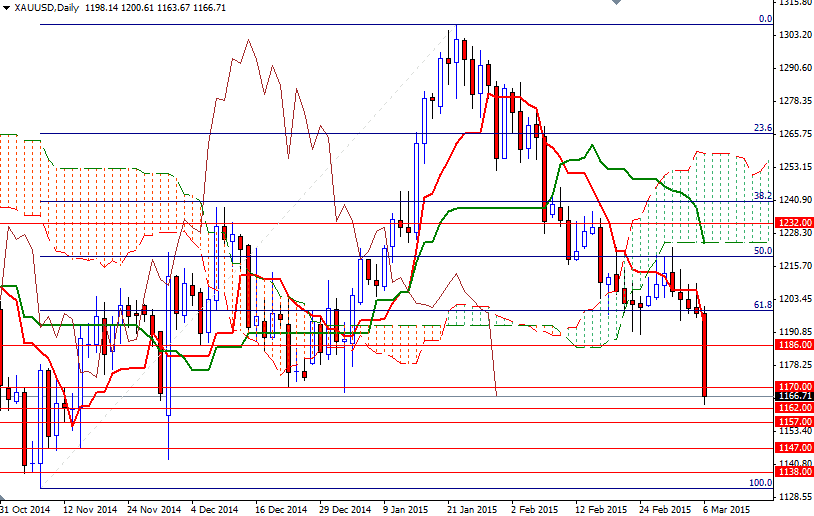

Gold prices ended Friday's session down 2.62%, or $31.43, to settle at $1166.71 an ounce as another encouraging U.S. jobs report boosted expectations the Federal Reserve will take a more hawkish tone on interest rates. The XAU/USD pair fell sharply after the Labor Department reported that the economy added 295K jobs in February, far surpassing consensus estimates of 240K, and the unemployment rate dropped to a more than six-year low of 5.5%. A plunge in U.S. unemployment to the lowest level since 2008 will probably help assure Federal Reserve policy makers that the economy is strong enough to withstand an increase in withstand an increase in interest rates by mid-year.

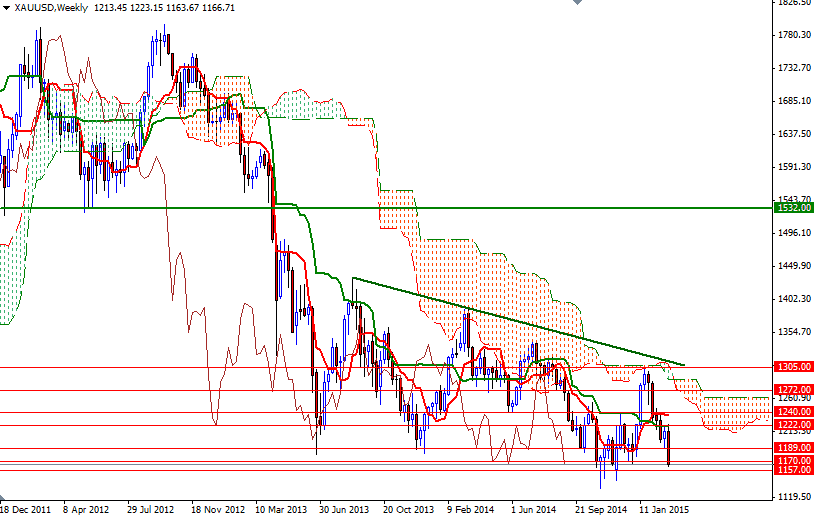

Gold has come under renewed pressure in recent weeks, as investors flock to equities markets and the dollar. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 116000 contracts, from 126171 a week earlier. Lately, I have been repeating that trading below the Ichimoku clouds on the weekly, daily and 4-hour charts indicate that the broader directional bias remains weighted to the downside. This will be the case until both the daily and 4-hour charts point in the same direction.

Closing below the 1170 support level suggests that the bears are firmly in control, plus the Chikou-span (closing price plotted 26 periods behind, brown line) line is now moving below the daily cloud as a result of Friday's decline. That means if the market can't get back above the 1189/6 area, there will be a continuation of the downward pressure. On its way down, support can be seen at 1162, 1157 and 1147. If we did break down below the 1138 level though, we could go as low as the 1092 level. If the XAU/USD pair turns north and climbs above 1172/0, look for resistance at 1179/8 before reaching the 1189/6 zone. In the meantime, I will also keep an eye on the major stock markets. A sizable correction in The U.S and Japan stock exchanges might increase desire for safe haven diversification.