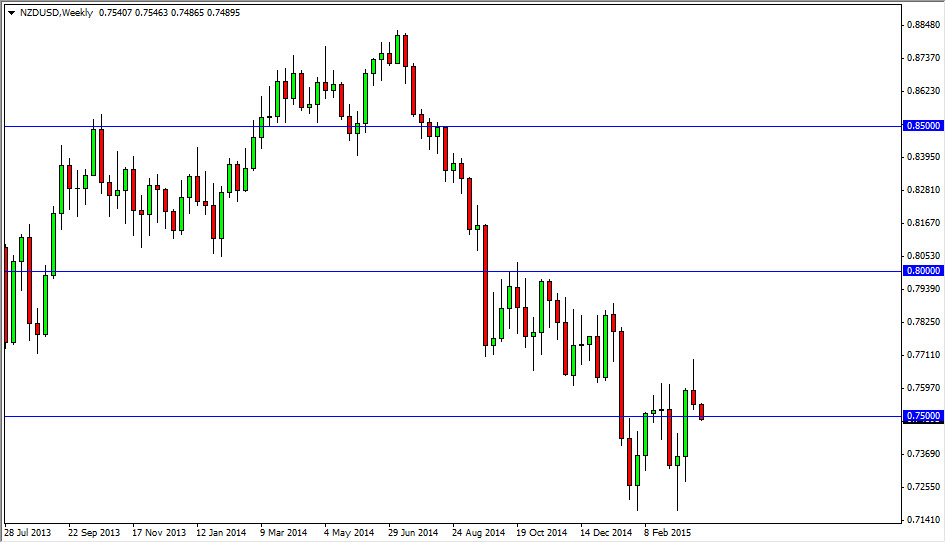

The NZD/USD pair has been all over the place recently, but right now looks as if it’s heading below the 0.75 handle again. With that being the case, I believe that the month of April is going to be fairly bearish for the New Zealand dollar, but I do not expect any type of collapse. In other words, I believe that the market will continue to bang around between the 0.76 level and the 0.72 handle. Ultimately, I do think that we break down below there but I think it’s going to take some time. After all, this market has a history of going sideways for a time and then finally making an impulsive move. You never really know what is going to happen, but right now it just looks like it wants to find some type of sideways action.

[CAD:FXAcademy CTA #121]Selling rallies

I continue to sell rallies in this market as I have no interest in owning the New Zealand dollar or anything else that is so heavily influenced by commodities in general. Commodity markets look very soft, and even if they rallied from here, would have to go significantly higher to justify any type of rally in the commodity currencies. The New Zealand dollar of course will be no different, and as a result I am very bearish of this particular pair. The US dollar continues to be the favored currency around the world, and that isn’t going to change anytime soon.

The New Zealand dollar is highly leveraged to not only commodities but the Asian markets as well. Asian markets aren’t exactly looking like they’re on fire, and there is the possibility of a rate cut out of China. If that happens, that could way more upon the New Zealand dollar as well as so much of the Kiwi trade goes to China. I believe that every time this market rallies, you will have to be suspicious and start looking for opportunities to sell.