USD/JPY Signal Update

Yesterday’s signals expired without being triggered, although there was a bullish pin bar off a support level I had identified earlier at 119.79. I believe it would be wise to exit from any long trade taken there now or at the very least, to take the risk off the trade.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

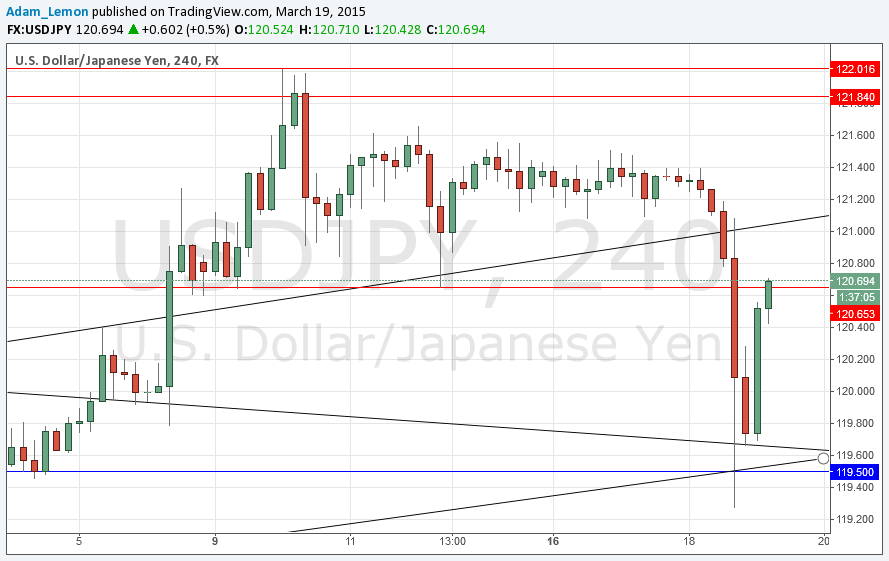

• Short entry following some bearish price action on the H1 time frame immediately upon the next test of 120.66.

• Put the stop loss 1 pip above the local swing high.

• Adjust the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

• Short entry following some bearish price action on the H1 time frame immediately upon the next test of the broken bullish trend line currently sitting at around 121.05.

• Put the stop loss 1 pip above the local swing high.

• Adjust the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

This pair actually fluctuated by less compared to all the other major USD pairs following the FOMC announcement yesterday. The USD actually began to fall notably before the announcement, breaking through the bullish trend line cleanly and significantly. The FOMC pushed the price down to the supportive confluence of two older trend lines and the anticipated support at 119.79, from where it has risen. At the time of writing the price is not far from a previously supportive inflection point that may provide a short opportunity. Above that, there is the old bullish trend line that may also now become resistant. There is not enough clarity below to identify any good long opportunities within reach.

There are no high-impact events scheduled today concerning the JPY. Regarding the USD, at 2pm London time there will be a release of Philly Fed Manufacturing Index data which may affect the USD.